According to our analysis there was a potential of 391 pips, US500 13 points and BTC 177 points profit out of the following 5 events in January 2026. The potential performance in 2025 was 1,828 pips / ticks.

January 2026

USDA WASDE (World Agricultural Supply and Demand Estimates) (200 ticks / 12 January 2026)

US BLS Consumer Price Index (CPI) (5 pips, US500 13 points, BTC 177 points / 13 January 2026)

DOE Natural Gas Storage Report (WNGSR) (66 ticks / 15 January 2026)

DOE Natural Gas Storage Report (WNGSR) (103 ticks / 22 January 2026)

DOE Natural Gas Storage Report (WNGSR) (17 ticks / 29 January 2026)

Total trading time would have been around 4 minutes! (preparation time not included)

You can click on each release for detailed information.

January 2026 Macro & Commodity Volatility Recap: USDA, CPI, and DOE Data Drive Fast Markets

February 1, 2026

January 2026 delivered a dense run of high-impact U.S. macroeconomic and commodity data releases—and markets responded with speed. From grains and natural gas to FX, equity indices, and crypto, low-latency reactions created measurable short-term trading opportunities across multiple asset classes.

According to Haawks G4A analysis, USDA, CPI, and DOE releases generated hundreds of ticks and pips of potential performance, reinforcing the importance of machine-readable data in time-sensitive trading strategies.

Performance Snapshot — January 2026

USDA WASDE & Grain Stocks (Jan 12): ~200 ticks

US CPI (Jan 13):

EURUSD: 5 pips

US500: 13 points

BTC: 177 points

DOE Natural Gas Storage Reports:

Jan 15: 66 ticks

Jan 22: 103 ticks

Jan 29: 17 ticks

Total potential performance (2026 YTD): 391 pips

(2025 full year: 1,828 pips)

USDA WASDE & Grain Stocks — January 12, 2026

Big Crops, Rising Stocks, and Mixed Price Signals

The January WASDE (Report 667), released by the United States Department of Agriculture, confirmed a clear theme of abundant supply across most major crops.

Grains Reaction

Futures volatility was concentrated in:

Soybeans (ZS): ~80 ticks

Corn (ZC): ~60 ticks

Wheat (WC): ~60 ticks

Key Fundamentals

Corn:

Record U.S. production at 17.0 billion bushels

Yield: 186.5 bu/acre

Ending stocks: 2.2 billion bushels

Price forecast: $4.10/bu

Wheat:

Ending stocks: 926 million bushels

Season-average price: $4.90/bu

Global stocks rise to 278.3 million tons

Soybeans:

Production: 4.3 billion bushels

Ending stocks: 350 million bushels

Price forecast cut to $10.20/bu

Brazil crop raised to 178 million tons

Grain Stocks Confirmation

December 1 inventories reinforced the supply-heavy narrative:

Corn: +10% YoY

Soybeans: +6%

Wheat: +7%

Grain sorghum: +26%

Market takeaway: Record production and expanding global stocks capped upside volatility, but headline numbers still triggered fast intraday futures reactions.

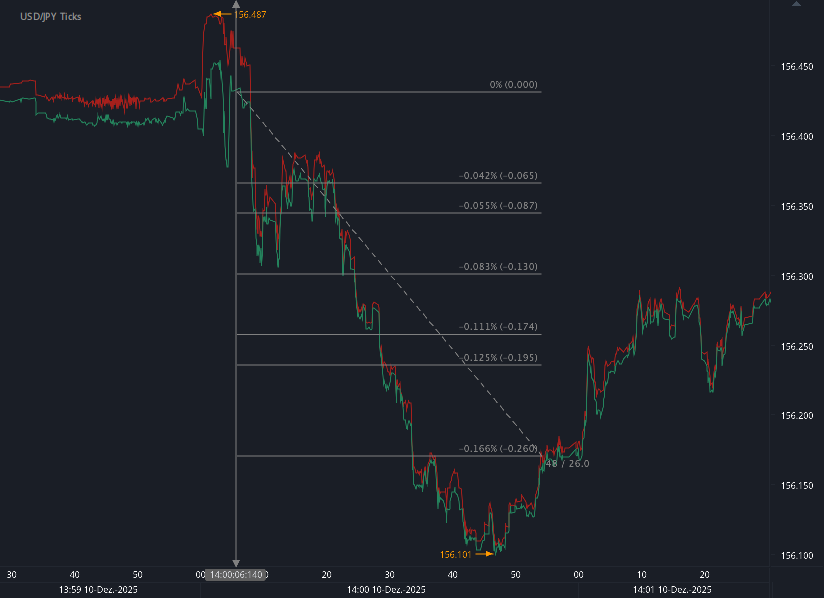

US CPI — January 13, 2026

Inflation Ends 2025 Steady, Not Fully Subdued

The December CPI report from the U.S. Bureau of Labor Statistics kept inflation expectations stable—but markets still reacted immediately.

Market Moves (First Minute Reaction)

EURUSD: 5 pips

US500: 13 points

BTC: 177 points

Key Inflation Data

Headline CPI (MoM): +0.3%

YoY CPI: 2.7%

Core CPI: 2.6%

Notable Drivers

Shelter inflation remained sticky (+3.2% YoY)

Food prices accelerated (+0.7% MoM)

Gasoline fell, but electricity and natural gas rose sharply YoY

Services inflation remained firm

Market takeaway: Inflation is no longer accelerating, but persistence in housing and services continues to matter for rates, FX, and risk assets.

DOE Natural Gas Storage Reports — January 2026

Big Draws, But No Supply Stress

Natural gas futures reacted to every January storage release, with volatility driven by withdrawal size versus expectations rather than absolute inventory levels.

All reports were released by the U.S. Energy Information Administration.

January 15 Report (Week Ending Jan 9)

Withdrawal: 71 Bcf

Futures move: 66 ticks

Total storage: 3,185 Bcf

+106 Bcf vs. 5-year average

January 22 Report (Week Ending Jan 16)

Withdrawal: 120 Bcf

Futures move: 103 ticks

Total storage: 3,065 Bcf

+177 Bcf vs. 5-year average

Despite accelerating withdrawals, inventories remained well above normal.

January 29 Report (Week Ending Jan 23)

Withdrawal: 242 Bcf

Futures move: 17 ticks in 7 seconds

Total storage: 2,823 Bcf

+143 Bcf vs. 5-year average

Regional draws were led by:

South Central: −89 Bcf

Midwest: −76 Bcf

East: −55 Bcf

Western regions remained more than 30% above five-year averages.

Market takeaway: Winter demand intensified, but storage buffers remained sufficient—keeping price reactions fast but contained.

Final Thoughts

January 2026 reinforced a recurring theme across asset classes:

Speed matters more than direction in news-driven markets

Even supply-heavy fundamentals can generate sharp short-term volatility

Machine-readable data remains critical for trading USDA, CPI, and DOE releases

With weather, exports, inflation expectations, and seasonal demand still in play, event-driven volatility is likely to persist into February.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Always conduct thorough research and consider seeking advice from a financial professional before making any investment decisions.

Start futures/forex/oil/grains news trading with Haawks G4A low latency machine-readable data today, we offer one of the fastest machine-readable data feeds for US macro-economic and commodity data and macro-economic data from Norway, Sweden, Turkey, Switzerland and ECB interest rates and statement.

Please let us know your feedback and check out our G4A low latency data feed.

All data is machine readable and available via API access in Chicago, New York and London. Free trials.