According to our analysis USDJPY and EURUSD moved around 58 pips and US30 around 83 points on US Employment Situation (Non-farm payrolls / NFP) data on 3 November 2023.

USDJPY (36 pips)

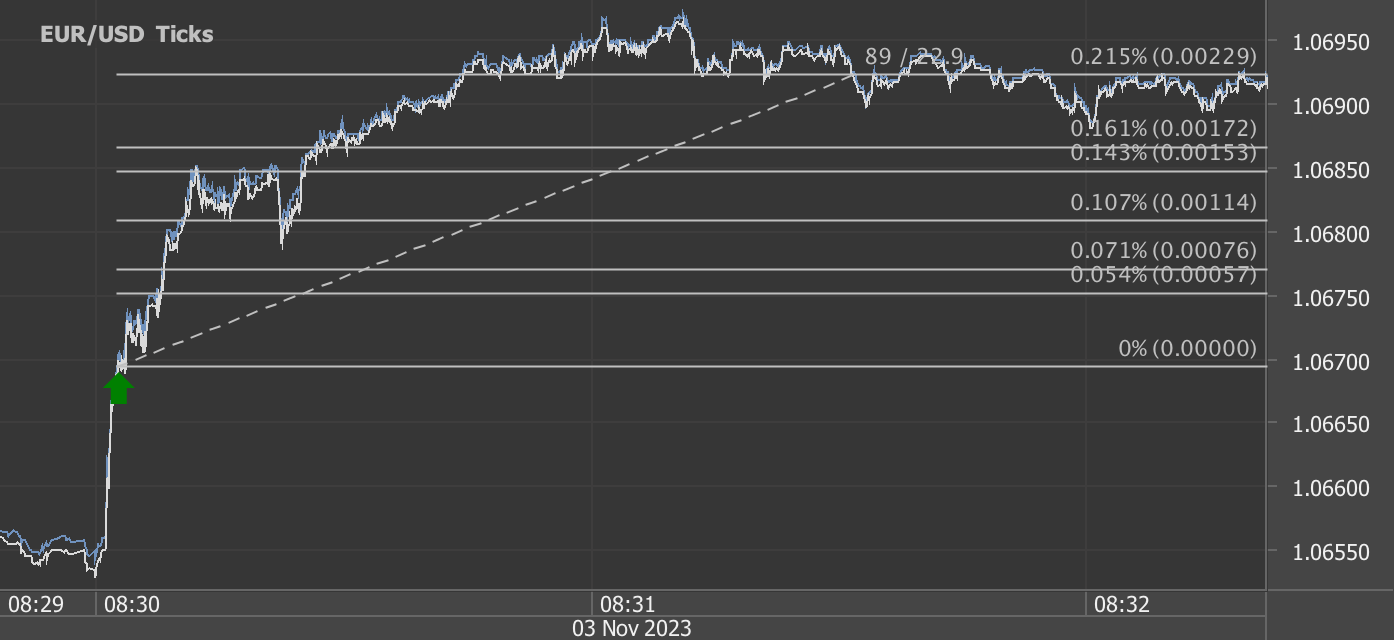

EURUSD (22 pips)

US30 (83 points)

Charts are exported from JForex (Dukascopy).

BLS Employment Report - October 2023:

The U.S. Bureau of Labor Statistics released its Employment Situation Summary for October 2023. The key points from the report are as follows:

Total nonfarm payroll employment increased by 150,000 in October.

The unemployment rate remained largely unchanged at 3.9 percent.

Job gains were seen in the health care, government, and social assistance sectors, while manufacturing employment declined due to strike activity.

Household survey data revealed that the unemployment rate stood at 3.9 percent, with 6.5 million unemployed persons.

Market Reaction:

In response to the BLS report, financial markets exhibited notable reactions:

USD/JPY: The USD/JPY currency pair moved 36 pips down, indicating a weakening of the U.S. Dollar against the Japanese Yen. This reaction in the forex market suggests concerns about the U.S. economic outlook.

EUR/USD: The EUR/USD currency pair moved 22 pips up, reflecting a strengthening of the Euro against the U.S. Dollar. This may imply confidence in the European economy relative to the U.S.

US30 (Dow Jones Industrial Average): The Dow Jones Industrial Average gained 83 points, suggesting positive sentiment in the stock market. Investors viewed the employment report as a positive sign for the U.S. economy.

Expectation vs. Reality:

It's important to note that the actual non-farm payroll figures in the October report deviated from expectations. While expectations were for a higher figure, the actual employment gains were reported at 150,000, which was below the anticipated number. This discrepancy between expectations and the actual result can impact market sentiment and trading strategies.

In summary, the BLS report for October 2023 showed modest job growth and relatively stable unemployment rates, with notable market reactions. The difference between the expected and actual non-farm payroll figures highlights the dynamic nature of economic data and its influence on financial markets.

Start forex fx futures news trading with Haawks G4A low latency machine-readable data today, one of the fastest news data feeds for US economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.