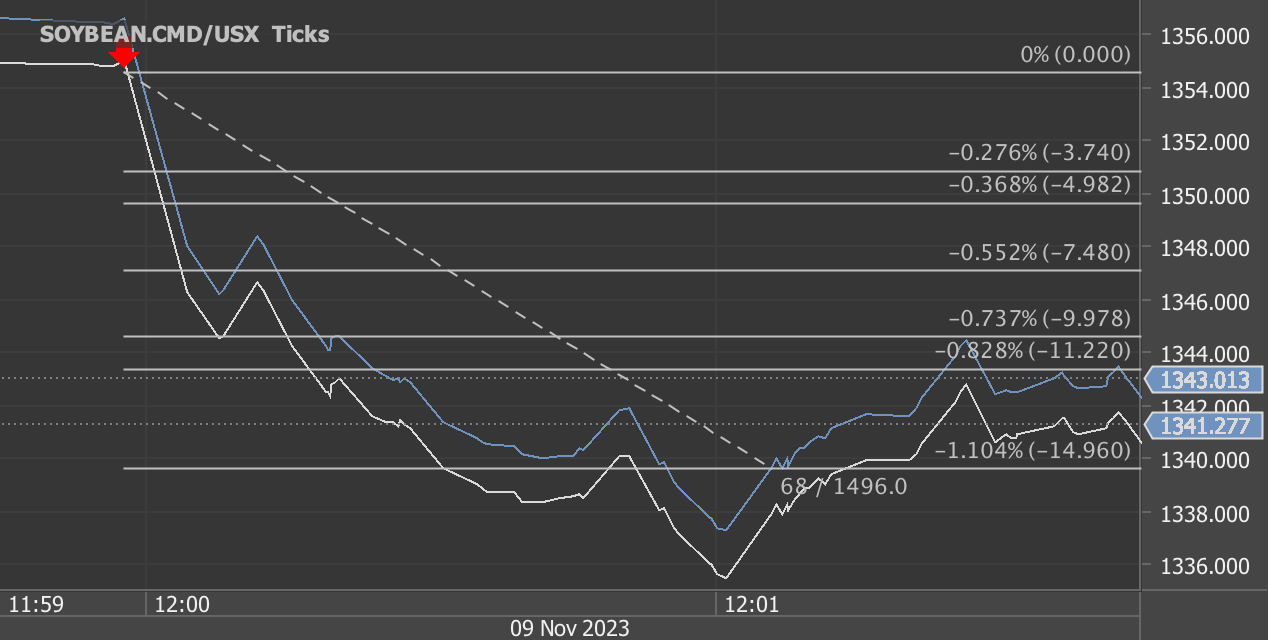

According to our analysis soybeans (ZS) and corn (ZC) futures prices moved around 76 ticks on USDA WASDE (World Agricultural Supply and Demand Estimates) data on 9 November 2023.

Soybeans (56 ticks)

Charts are exported from JForex (Dukascopy).

The October 2023 World Agricultural Supply and Demand Estimates (WASDE) report presents a comprehensive overview of various key agricultural sectors, both domestically in the United States and globally. Here are the highlights of the report along with additional information on market movements:

Wheat & Coarse Grains:

U.S. Wheat: Shows increased supplies, higher domestic use, and ending stocks due to augmented production.

Global Wheat: Indicates reduced supplies, consumption, trade, and stocks due to varied production changes across countries.

U.S. Corn: Forecasts decreased supplies, exports, and ending stocks because of reduced production and demand.

Global Coarse Grains: Reflects mixed production changes affecting trade and stocks across different countries.

Rice & Oilseeds:

U.S. Rice: Predicts slightly reduced supplies with increased exports. Global trade and supplies fluctuate slightly.

U.S. Oilseeds (Soybeans): Forecasts reduced production, impacting exports and supplies. Global oilseed production changes differ across nations, affecting trade and stocks.

Sugar, Livestock, Poultry, and Dairy:

Sugar: Reports supply changes in Mexico and the U.S., influenced by factors such as drought.

Livestock, Poultry, Dairy: Demonstrates adjustments in production, exports, imports, and price forecasts driven by factors like demand, market competition, and supply variations.

Cotton and Global Outlook:

Cotton: Forecasts lower U.S. production, exports, and ending stocks. Globally, changes in production and trade in various countries impact the overall market scenario.

Additionally, we noticed the following market movements:

Soybean Futures: Experienced a 56-tick downward movement, possibly in response to reduced U.S. soybean production and increased competition from South America.

Corn Futures: Witnessed a 20-tick decline, likely due to decreased U.S. corn production, slow early-season demand, and lower feed and residual use, as outlined in the report.

The market reaction was mixed, as reflected in the fluctuations across various commodities, indicating a complex interplay of supply, demand, and global factors. These adjustments hold implications for traders, investors, and policymakers, guiding them in making informed decisions within the dynamic agricultural landscape.

Haawks G4A is one of the fastest machine-readable data feeds for USDA data. We are beating big names in the industry by seconds. Coverage includes monthly USDA WASDE (World Agricultural Supply and Demand Estimates), quarterly USDA Grain Stocks and yearly USDA Prospective Plantings and USDA Acreage.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.