According to our analysis USDJPY and EURUSD moved 45 pips on FOMC Interest Rate Decision and Projections data on 10 December 2025.

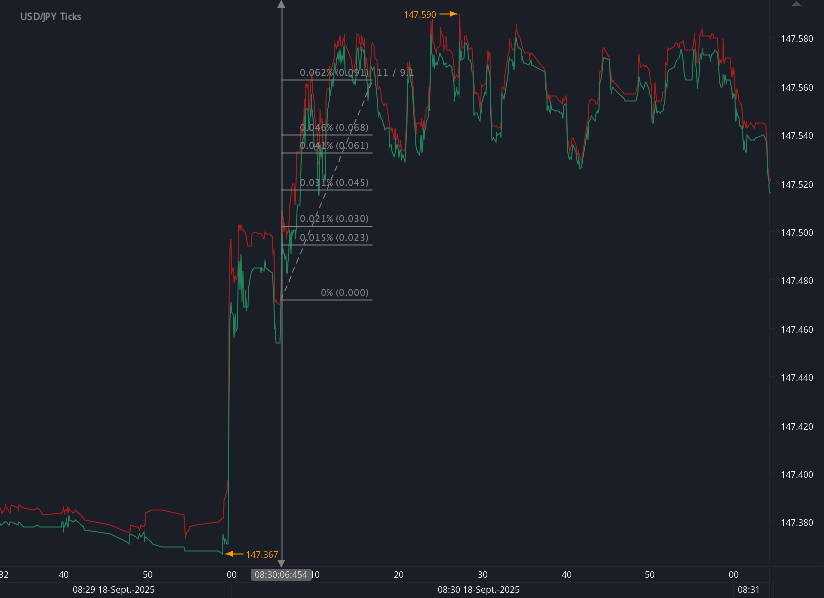

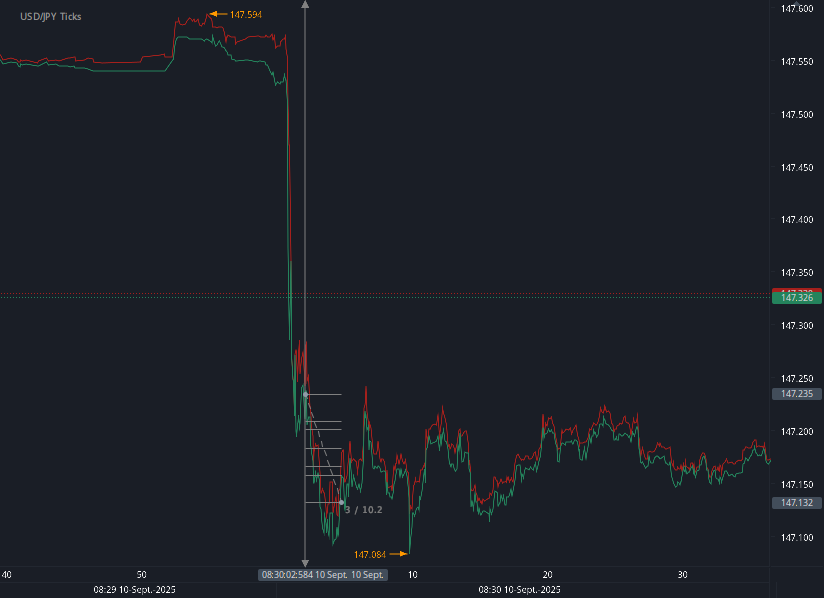

USDJPY (26 pips)

EURUSD (19 pips)

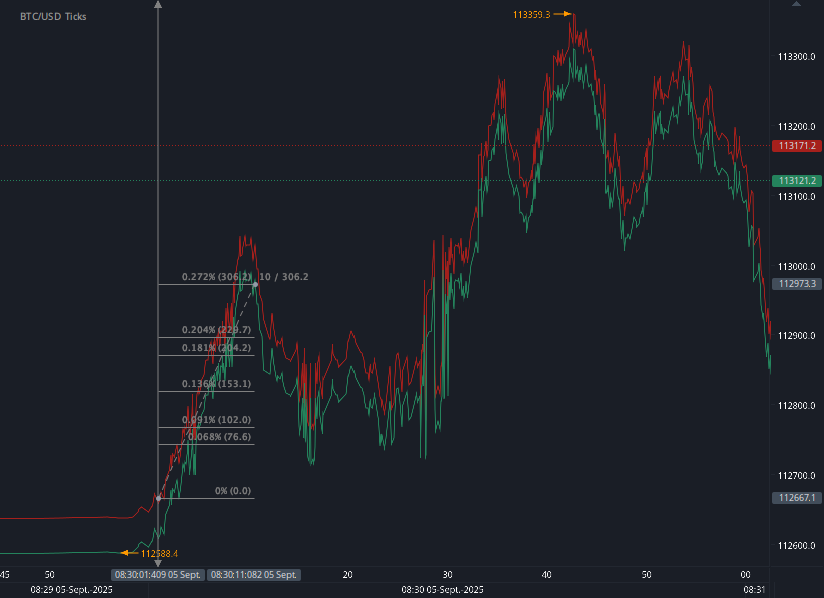

Charts are exported from JForex (Dukascopy).

The Fed Just Cut Rates: What the December 2025 Decision Really Means

On December 10, 2025, the Federal Reserve did something markets had been debating for months: it cut interest rates again.

The Federal Open Market Committee (FOMC) lowered the target range for the federal funds rate by 0.25 percentage point, to 3.50–3.75%, and released a fresh set of economic projections that stretch out to 2028. Alongside that, they gave us a pretty clear message:

Growth looks okay, inflation is still a bit too high, the labor market is softening, and the risks around the outlook are uncomfortably elevated.

Let’s unpack what was just announced, what the Fed is signaling about the future, and why the internal disagreements on the Committee really matter this time.

1. The Big Move: A 25bp Cut with Rising Concerns

The FOMC statement paints an economy that’s still growing, but more fragile:

“Economic activity has been expanding at a moderate pace.”

Job gains have slowed, and unemployment has edged up through September.

Inflation has moved up since earlier in the year and “remains somewhat elevated.”

Despite that uptick in inflation, the Fed chose to ease policy:

“The Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 3-1/2 to 3-3/4 percent.”

Why cut when inflation is higher than earlier in the year?

Because the Fed is increasingly worried about the downside risks to employment. The statement explicitly notes that downside risks to employment have risen in recent months, and that’s a big shift in emphasis. The Fed’s dual mandate (maximum employment and price stability) is now facing pressure from both sides at once.

2. The New Forecasts: Slightly Stronger Growth, Gradual Disinflation

The Summary of Economic Projections (SEP) lays out the Fed participants’ median forecasts for the economy from 2025–2028.

Real GDP Growth (Q4/Q4)

Median forecast:

2025: 1.7%

2026: 2.3%

2027: 2.0%

2028: 1.9%

Longer run: 1.8%

Compared with the September projections, growth is now expected to be a touch stronger in 2026 and 2027. The story: a soft-ish landing narrative is still alive—modest growth now, slightly firmer growth later, then easing back to the long-run trend.

Unemployment Rate (Q4 average)

Median forecast:

2025: 4.5%

2026: 4.4%

2027: 4.2%

2028: 4.2%

Longer run: 4.2%

Unemployment is projected to stay above the pre-pandemic lows and settle around what the Fed views as its longer-run normal. Compared to September, changes are small, but the message is that the labor market is no longer “red hot”—it’s moving closer to equilibrium, but with heightened risk it could weaken more than desired.

Inflation: PCE and Core PCE

Headline PCE inflation (Q4/Q4):

2025: 2.9%

2026: 2.4%

2027: 2.1%

2028: 2.0%

Longer run: 2.0%

Core PCE (excluding food & energy):

2025: 3.0%

2026: 2.5%

2027: 2.1%

2028: 2.0%

The Fed still expects a gradual glide path back to 2%, but:

Inflation in 2025 is now seen just a bit lower than September for headline (2.9% vs 3.0) and core (3.0% vs 3.1),

The journey back to 2% is long and uncertain, with inflation staying above target through 2026.

Put simply:

The Fed thinks inflation is heading in the right direction, but not fast enough to declare victory.

3. The Rate Path: Lower Now, but Still “Higher-for-Longer” Compared to Pre-2020

The “dot plot” (Figure 2 and the memo line in Table 1) shows where participants think the federal funds rate will be at year-end.

Median projected fed funds rate:

2025: 3.6%

2026: 3.4%

2027: 3.1%

2028: 3.1%

Longer run: 3.0%

Key takeaways:

The 2025 median is unchanged from September at 3.6%, even though the Fed has just cut to 3.5–3.75%. That implies only limited additional easing is currently envisioned for 2025.

Beyond 2025, rates are expected to drift lower but not plunge.

The longer-run neutral rate is still around 3.0%—a world where “normal” interest rates are structurally higher than the near-zero era of the 2010s.

So this is not a pivot back to ultra-easy money; it’s more like:

“We’re easing off the brakes, not slamming on the gas.”

4. Internal Divisions: The First Cut with Real Dissent

This meeting featured three dissents, underscoring real disagreement about what’s appropriate right now:

Stephen I. Miran voted for a bigger cut, preferring a 1/2 percentage point reduction.

Austan D. Goolsbee and Jeffrey R. Schmid voted against the cut, preferring no change in the target range this meeting.

So within the Committee you can see three camps:

Easers (Miran & likely some others quietly sympathetic): worried enough about growth and employment that they want faster easing.

“Mainstream” majority: sees a 25bp cut as the right compromise between still-elevated inflation and rising downside risks to jobs.

Hawks (Goolsbee, Schmid and possibly others): focused more on stubborn inflation and concerned that easing too soon could reignite price pressures.

When you see this kind of three-way split, it usually means the data are sending mixed signals and the margin for error looks uncomfortably small.

5. Balance Sheet & Reserves: Quiet but Important

One line in the statement may fly under the radar but matters for markets:

“The Committee judges that reserve balances have declined to ample levels and will initiate purchases of shorter-term Treasury securities as needed to maintain an ample supply of reserves on an ongoing basis.”

Translation:

The Fed thinks the banking system is now at an “ample” level of reserves.

To keep it that way, it’s prepared to buy short-term Treasuries as needed to avoid liquidity strains.

This is not a return to crisis-era quantitative easing; it’s more of a technical adjustment to stabilize the plumbing of the financial system. But for money markets and short-term funding, it’s a big signal of a steady, supportive backdrop.

6. Risks & Uncertainty: Elevated Across the Board

The SEP includes detailed information on how uncertain policymakers feel and which way they think risks are tilted.

A few notable patterns:

Uncertainty is high for GDP, unemployment, and both measures of inflation.

Most participants rate uncertainty as “higher” than the historical average over the last 20 years.

Risks to GDP growth are tilted to the downside.

More participants see a greater chance that growth comes in weaker rather than stronger.

Risks to inflation (both headline and core) are still tilted to the upside.

That is, there’s a meaningful probability that inflation proves stickier than forecast.

Put together, the Fed’s message is:

They’re worried about slower growth and higher unemployment, but they still don’t fully trust that inflation is conquered.

That’s why you see a cautious rate cut, not a full-on easing cycle signal.

7. What This All Means Going Forward

Here’s the big-picture read of the December 2025 Fed package:

The Fed is now in a rate-cutting phase, but not a panicked one.

A 25bp cut with a still-elevated rate path is consistent with a fine-tuning approach.

Growth is expected to remain positive, not collapse.

Median GDP growth picks up somewhat in 2026, suggesting the Fed is trying to engineer a soft landing, not bracing for a deep recession.

Labor markets are cooling, and that’s making the Fed nervous.

The explicit mention that downside risks to employment have risen is notable and politically important under their dual mandate.

Inflation is still above target for a while.

The Fed isn’t ready to declare a clean victory on inflation, which limits how aggressive they’re willing to be on cuts.

Dissent shows real tension in the Committee.

One member wants faster easing, two wanted no easing at all. Future meetings could be lively, especially if incoming data swing unexpectedly.

8. How to Think About This as an Investor, Business, or Household

Without giving specific investment advice, here are some conceptual implications:

Borrowing costs may drift lower, but not crash.

Mortgage and corporate borrowing rates are likely to ease somewhat over time, but the Fed’s longer-run rate around 3% still implies a higher interest rate world than the pre-2020 decade.Growth assets vs. safe assets:

A gentle rate-cutting path with still-positive growth tends to support risk assets, but the elevated uncertainty and inflation risks mean volatility isn’t going away.Jobs outlook:

The Fed is very focused on the labor market. If unemployment rises more quickly than forecast, the Fed could cut faster than the current dots imply—but they will be looking over their shoulder at inflation the whole time.

Final Thought

This December 2025 meeting is not a dramatic pivot; it’s a delicate adjustment in an environment where both sides of the Fed’s mandate look fragile.

The Fed is saying:

“We’re easing a bit to support the labor market.”

“We still think inflation is too high.”

“And honestly, we’re not very confident how this all plays out.”

In other words: welcome to the age of cautious cuts and uncomfortable uncertainty.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Always conduct thorough research and consider seeking advice from a financial professional before making any investment decisions.

Source: https://www.federalreserve.gov/newsevents/pressreleases/monetary20251210a.htm, https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20251210.htm

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feeds for US macro-economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.