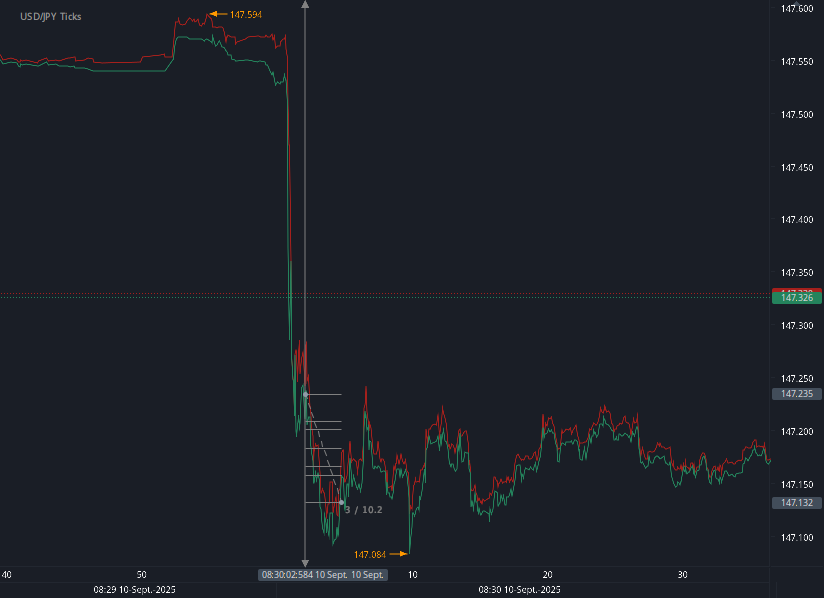

According to our analysis USDJPY and EURUSD moved 14 pips and BTC moved 674 points on US BLS Producer Price Index (PPI) data on 10 September 2025.

USDJPY (10 pips)

EURUSD (4 pips)

BTC (674 points)

Charts are exported from JForex (Dukascopy).

U.S. Producer Prices Slip in August; Core PPI (Ex-Food & Energy) Down 0.1%

The Bureau of Labor Statistics reported that headline PPI for final demand fell 0.1% in August 2025. Over the past year, producer prices are up 2.6%.

Key takeaways

Core PPI (ex food & energy) fell 0.1% m/m and is up 2.8% y/y.

Final demand services declined 0.2% m/m, led by a 1.7% drop in trade service margins (wholesalers/retailers).

Final demand goods edged +0.1% m/m: core goods rose +0.3%, foods +0.1%, while energy -0.4%.

Within services, margins for machinery & vehicle wholesaling -3.9%, while portfolio management +2.0% and freight +0.9% rose.

Intermediate stages were mixed: processed goods +0.4%, unprocessed goods -1.1%, and services +0.3%.

What’s moving underneath

Goods firmness came from tobacco (+2.3%), beef, processed poultry, electronics components, and electric power.

Offsets included utility natural gas (-1.8%), vegetables, eggs, and copper scrap.

On the pipeline side, stage 4 intermediate demand +0.5% (11th straight rise), while stage 2 -0.2%.

Why this matters

A negative core print (ex food & energy) at -0.1% m/m suggests some cooling in underlying producer-level inflation even as select core goods remain sticky. Combined with softer services margins, August points to easing pipeline pressures, though the y/y pace remains above pre-pandemic norms.

Next up: September PPI arrives October 16, 2025.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Always conduct thorough research and consider seeking advice from a financial professional before making any investment decisions.

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feed for US economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.