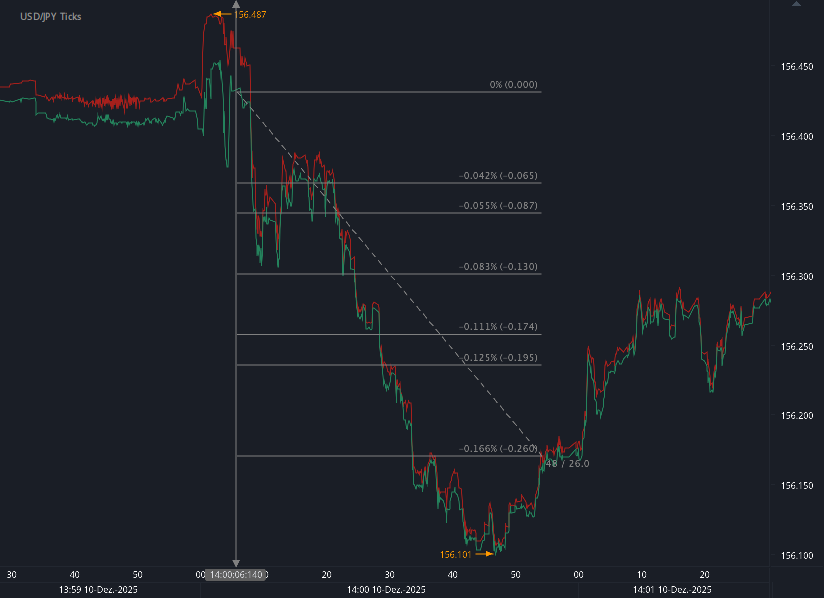

According to our analysis natural gas moved 41 ticks on DOE Natural Gas Storage Report (WNGSR) data on 19 February 2026.

Natural gas (41 ticks)

Charts are exported from JForex (Dukascopy).

Weekly Natural Gas Storage Update: Inventories Fall 144 Bcf as Winter Withdrawals Continue

The latest Weekly Natural Gas Storage Report released February 19, 2026, by the U.S. Energy Information Administration (EIA) shows a substantial drawdown in natural gas inventories for the week ending February 13, 2026. As winter demand remains elevated, working gas in underground storage across the Lower 48 states declined by 144 billion cubic feet (Bcf).

Total Storage Snapshot

As of February 13, total working gas in storage stands at 2,070 Bcf, down from 2,214 Bcf the previous week. Key comparisons include:

59 Bcf below the same week in 2025

123 Bcf below the five-year average (2,193 Bcf)

Still within the five-year historical range

While inventories are trailing both last year and the five-year average, they remain within normal seasonal boundaries—suggesting that, despite strong withdrawals, storage levels are not yet in concerning territory.

Regional Breakdown

East Region

Current stocks: 388 Bcf

Weekly change: –50 Bcf

8.9% below last year

16.9% below five-year average

The East posted one of the largest weekly withdrawals, reflecting persistent heating demand in densely populated markets.

Midwest

Current stocks: 457 Bcf

Weekly change: –53 Bcf

9.1% below last year

18.4% below five-year average

The Midwest experienced the largest regional draw, consistent with colder seasonal temperatures and strong residential and commercial demand.

South Central

Current stocks: 747 Bcf

Weekly change: –37 Bcf

7.4% below last year

10.2% below five-year average

Salt facilities: 168 Bcf (–8 Bcf week over week)

Nonsalt facilities: 579 Bcf (–29 Bcf week over week)

Salt storage facilities, often used for high-deliverability needs during peak demand, continue to see steady withdrawals.

Mountain Region

Current stocks: 207 Bcf

Weekly change: –2 Bcf

12.5% above last year

44.8% above five-year average

The Mountain region remains notably stronger than historical norms, providing a relative buffer compared to other regions.

Pacific Region

Current stocks: 271 Bcf

Weekly change: –2 Bcf

29.0% above last year

41.1% above five-year average

The Pacific region continues to maintain comfortable inventory levels relative to both last year and the five-year average.

Market Context

A 144 Bcf withdrawal is a sizable weekly decline, typical of mid-February when winter demand often peaks. The cumulative deficit versus the five-year average has widened to 123 Bcf, but overall inventories remain within seasonal norms.

From a market perspective, traders and analysts will closely monitor:

Late-season cold weather risks

Production trends

LNG export demand

End-of-season storage projections

If withdrawals continue at an above-average pace, the market could enter injection season with tighter inventories than desired, potentially supporting upward price pressure.

Statistical Reliability

The EIA reports a coefficient of variation of 0.5% for total stocks, indicating a high level of statistical reliability. The standard error for the net change is 0.9 Bcf, suggesting that the reported 144 Bcf draw is well outside the margin of sampling variability.

Looking Ahead

The next storage report will be released February 26, 2026. With only a few weeks remaining in the traditional withdrawal season, attention is shifting toward:

End-of-March storage levels

Early injection season dynamics

Summer supply-demand balance

For now, inventories remain adequate but leaner than historical norms—a dynamic that could shape market sentiment heading into spring.

As always, natural gas storage remains one of the most closely watched indicators of U.S. energy market health.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Always conduct thorough research and consider seeking advice from a financial professional before making any investment decisions.

Source: https://ir.eia.gov/ngs/ngs.html

Start futures forex fx commodity news trading with Haawks G4A low latency machine-readable data, one of the fastest data feeds for DOE data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.