According to our analysis USDJPY and EURUSD moved 20 pips on US Philadelphia Federal Reserve Bank Manufacturing Business Outlook Survey data on 18 April 2024.

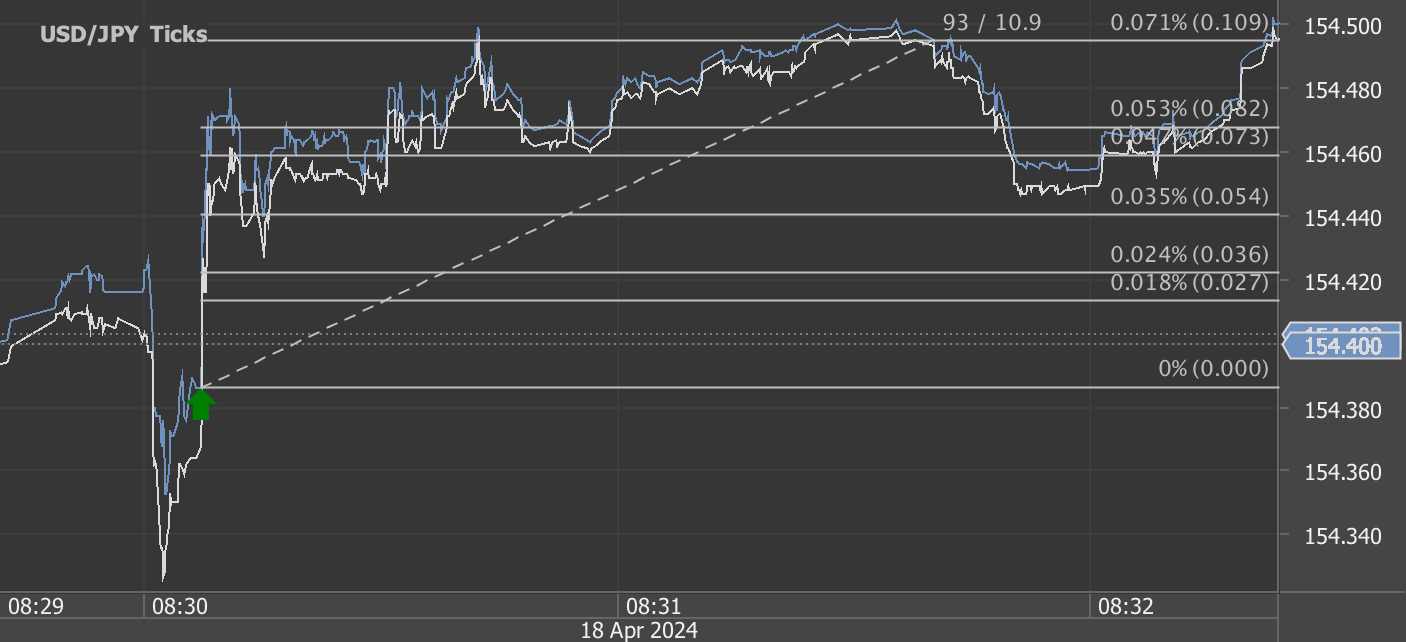

USDJPY (10 pips)

EURUSD (10 pips)

Charts are exported from JForex (Dukascopy).

Analyzing the April 2024 Manufacturing Business Outlook Survey: Key Insights and Implications

The April 2024 Manufacturing Business Outlook Survey provides valuable insights into the current state and future expectations of regional manufacturing activity. Collected from April 8 to April 15, the responses offer a comprehensive overview of various economic indicators and their potential impacts on the sector.

Current Manufacturing Trends

In April, the survey highlights a continued expansion in manufacturing activity. Notably, the diffusion index for current general activity increased by 12 points to 15.5, marking its highest level since April 2022. This rise reflects improved sentiments among manufacturers, with approximately 38% of firms reporting increases in general activity. This positivity is further supported by gains in new orders and shipments, suggesting a robust demand and operational uptick.

Despite these positive signs, the employment index remained in the negative territory at -10.7, continuing a trend observed over the past 14 months. The decline indicates ongoing challenges in the labor market within manufacturing, with firms reporting a higher rate of employment decreases compared to increases. This aspect of the survey underscores a critical area of concern that could affect production capacity and growth prospects if prolonged.

Price Dynamics

Price indexes from the survey indicate sustained pressure on costs. The prices paid index soared to 23.0 in April from 3.7 in March, signaling that input costs remain a significant challenge. This increase is near the long-run average but reflects heightened cost conditions that could squeeze margins if not managed effectively. Concurrently, the prices received index modestly increased, suggesting that firms are somewhat able to pass these costs onto consumers, but not entirely.

Future Outlook

Looking ahead, the survey’s future indicators, although slightly declined, still paint an optimistic picture for the next six months. The future general activity index, despite a drop, shows that a larger proportion of firms anticipate an increase in activity compared to those expecting a decrease. This optimism extends to projections for new orders and shipments, although at a moderated pace.

Interestingly, the future employment index saw an improvement, hinting at potential recovery in hiring intentions. This could be crucial in addressing the current employment declines and supporting anticipated increases in production.

Special Focus: Wages and Compensation

The survey included special questions about changes in wages and compensation. Over the past three months, 31.3% of firms reported increases in these costs, reflecting the broader inflationary pressures affecting the economy. Most firms have not adjusted their 2024 budgets for wages and compensation, indicating a wait-and-see approach in financial planning. However, a notable fraction of firms plan to increase wages more than initially planned, highlighting the competitive pressures to attract and retain talent amid a tight labor market.

Strategic Implications for Businesses

Manufacturing firms should remain vigilant of the ongoing cost pressures and labor market dynamics. Strategic planning should consider potential cost escalations and explore efficiencies in production processes. Additionally, firms must assess their workforce strategies to address the hiring challenges and plan for wage adjustments that align with market conditions and company performance.

Overall, the April 2024 Manufacturing Business Outlook Survey presents a mixed but cautiously optimistic view of the manufacturing sector. While current conditions show improvement, the challenges in employment and rising costs are critical areas that require careful management to sustain growth and competitiveness in the evolving economic landscape.

Source: https://www.philadelphiafed.org/surveys-and-data/regional-economic-analysis/mbos-2024-04

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feeds for US macro-economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.