According to our analysis USDJPY and EURUSD moved 35 pips on US BLS Producer Price Index (PPI) data on 11 April 2024.

USDJPY (19 pips)

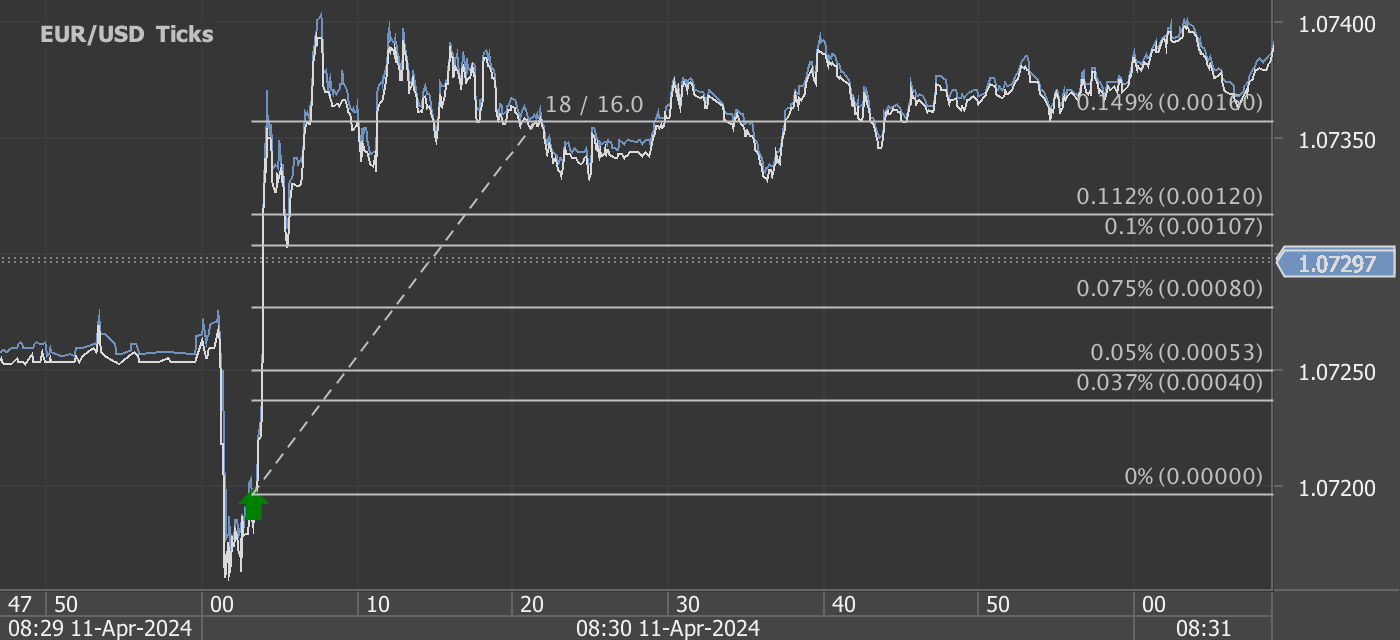

EURUSD (16 pips)

Charts are exported from JForex (Dukascopy).

Unpacking the March 2024 Producer Price Index: A Subtle Shift in Economic Trends

In March 2024, the Producer Price Index (PPI) for final demand demonstrated a modest increase of 0.2 percent, seasonally adjusted, according to the latest report from the U.S. Bureau of Labor Statistics. This subtle uptick follows more significant rises in previous months—0.6 percent in February and 0.4 percent in January. Notably, this marked a slight cooling in the pace of price increases faced by producers in the United States. Here’s a deeper dive into the nuances of the March 2024 PPI report and what these figures could signify for the broader economy.

Overview of March 2024 PPI Increases

Over the past year, the unadjusted final demand index has grown by 2.1 percent, the largest 12-month advance since a 2.3 percent increase recorded in April 2023. This year-on-year growth is primarily driven by a 0.3 percent rise in prices for final demand services, contrasting with a slight decline of 0.1 percent in the index for final demand goods.

Detailed Insights:

Services Sector: The increase in services was broad-based, with significant contributions from sectors like securities brokerage, dealing, investment advice, and related services, which surged by 3.1 percent. This was balanced by a notable decline in traveler accommodation services, which dropped by 3.8 percent.

Goods Sector: The decline in goods was led by a 1.6 percent decrease in final demand energy prices, emphasizing the volatile nature of this category. On a positive note, prices for final demand foods rose by 0.8 percent, showing some sectors still face upward pricing pressures.

Core Inflation Measures

Stripping out the often volatile prices of food, energy, and trade services, the core PPI (final demand less foods, energy, and trade services) moved up by 0.2 percent in March, mirroring the general trend of modest inflation in more stable categories. This core measure has risen by 2.8 percent over the past 12 months, indicating a relatively steady inflationary environment in the core sectors of the economy.

Intermediate Demand Dynamics

The report also sheds light on intermediate demand, which tracks prices for goods, services, and construction products sold for resale, export, or as inputs to other products. In March, prices for processed goods for intermediate demand fell by 0.5 percent, largely due to a 1.5 percent drop in processed energy goods. This reflects broader declines in energy costs that could influence future final demand prices.

Conversely, prices for services for intermediate demand ticked up by 0.2 percent, supported by increases in sectors such as investment banking and metals wholesaling. These increases are important indicators of cost pressures within the service sector that could trickle down to consumer prices.

Implications for Business and Policy

For businesses, the fluctuating PPI indicates a mixed bag of cost pressures that could affect profit margins and pricing strategies. The rise in services costs, particularly in financial services, might lead to higher operational expenses, whereas the drop in goods prices, especially energy, could provide some relief.

From a policy perspective, the Federal Reserve and other policymakers will likely scrutinize these figures to assess inflationary trends and adjust monetary policy accordingly. The core PPI's steady rise suggests that underlying inflation pressures remain manageable, which could influence interest rate decisions in upcoming meetings.

Conclusion

The March 2024 PPI report highlights a complex economic landscape with divergent trends in goods and services. As we move further into 2024, businesses and policymakers must remain vigilant and adaptable to these evolving economic indicators. By understanding these trends, stakeholders can better navigate the uncertainties and opportunities that lie ahead in the dynamic U.S. economy.

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feed for US economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.