According to our analysis USDJPY and EURUSD moved 12 pips on US Jobless Claims and US Philadelphia Federal Reserve Bank Manufacturing Business Outlook Survey data on 21 March 2024.

USDJPY (9 pips)

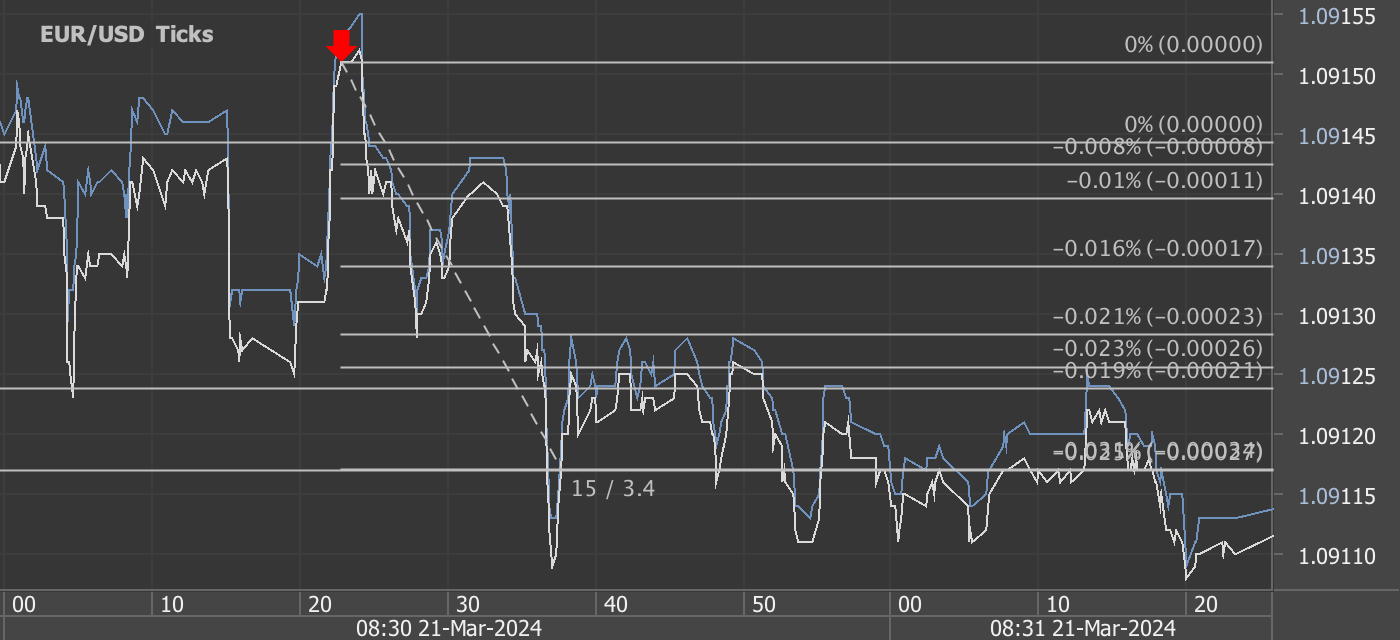

EURUSD (3 pips)

Charts are exported from JForex (Dukascopy).

Unpacking the March 2024 Manufacturing Business Outlook Survey Insights

The latest Manufacturing Business Outlook Survey, with responses gathered between March 11 and March 18, 2024, offers a nuanced view of the manufacturing sector's current health and its prospects. The survey, a bellwether for manufacturing trends, presents a mix of cautious optimism and areas of concern, reflecting the complex dynamics influencing the sector. Let’s delve into the key takeaways and what they mean for the industry moving forward.

Modest Growth Amidst Challenges

The survey underscores a continued expansion in manufacturing activity, albeit at a pace that suggests caution among industry players. The general activity index, a key measure of manufacturing health, recorded a slight dip to 3.2 in March, marking its second consecutive positive reading but highlighting a tempered outlook among firms. This modest growth is further evidenced by the positive turn in new orders, with the index rising to 5.4, and a slight uptick in shipments.

However, not all indicators are positive. The employment index remained in negative territory at -9.6, suggesting ongoing challenges in workforce dynamics. Moreover, both price indexes for inputs and outputs have decreased, remaining below long-run averages, pointing to a complex pricing environment faced by manufacturers.

Current Indicators and Future Outlook

While current indicators reflect a mixed bag of modest growth and persisting challenges, the future outlook provides a brighter picture. The future general activity index leapt to 38.6, the highest since July 2021, indicating stronger expectations for growth in the coming months. This optimism is echoed in the significant increases in future new orders and shipments indexes, suggesting that firms are anticipating a rebound in demand.

Furthermore, the survey’s special questions reveal insights into production growth and capacity utilization, with a higher share of firms reporting an increase in production for the first quarter of 2024 compared to the last quarter of 2023. The median current capacity utilization rate remains stable, with most firms indicating slight to moderate constraints from labor supply but less concern from supply chains.

Implications for the Manufacturing Sector

The March 2024 survey paints a picture of a manufacturing sector at a crossroads. On one hand, the continued expansion and optimistic future expectations reflect the resilience and potential for growth within the industry. On the other, the challenges in employment and price pressures underscore the ongoing adjustments firms must navigate in a post-pandemic world.

For industry leaders, the key takeaway is the importance of strategic planning and flexibility. Investing in workforce development and technology can help mitigate employment challenges, while agile pricing strategies may address the volatile cost environment. Moreover, the positive future outlook suggests that firms should prepare for increased demand, making this an opportune time to review and enhance production capabilities.

Looking Ahead

As the manufacturing sector continues to navigate through a landscape marked by both opportunities and challenges, the insights from the March 2024 Manufacturing Business Outlook Survey offer valuable guidance. By understanding the current trends and future expectations, manufacturers can better position themselves for growth, adapting to the evolving market dynamics with resilience and strategic foresight.

Source: https://www.philadelphiafed.org/surveys-and-data/regional-economic-analysis/mbos-2024-03

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feeds for US economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.