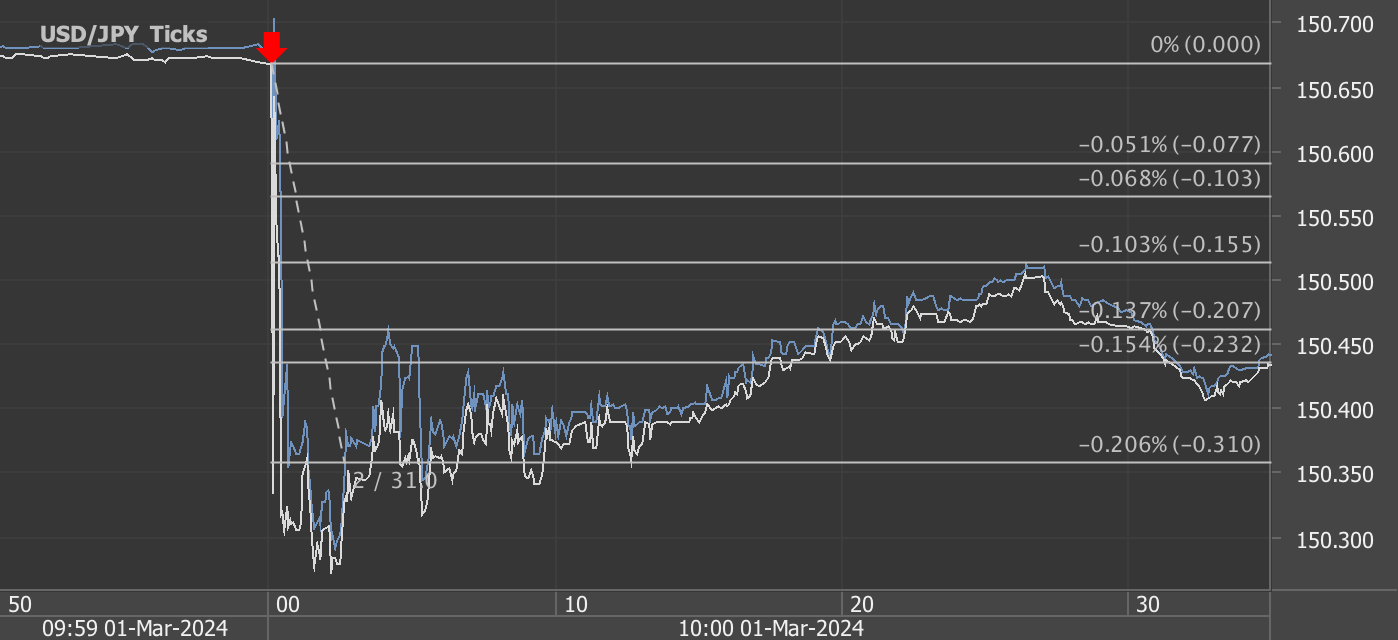

According to our analysis USDJPY and EURUSD moved 51 pips on University Michigan Consumer Sentiment / Inflation Expectations data on 1 March 2024.

USDJPY (31 pips)

EURUSD (20 pips)

Charts are exported from JForex (Dukascopy).

Analyzing the February 2024 Consumer Sentiment: A Closer Look at Economic Perspectives

As we delve into the latest data from February 2024, a nuanced picture of consumer sentiment emerges, reflecting a complex interplay of expectations, current economic conditions, and inflation perceptions. The February report showcases a slight decline in consumer sentiment, with the Index of Consumer Sentiment falling to 76.9 from January's 79.0, marking a 2.7% decrease. Despite this month-to-month slip, the year-over-year comparison reveals a robust 14.9% increase from February 2023's 66.9, highlighting a significant uplift in consumer confidence over the past year.

Current Economic Conditions and Expectations

The Current Economic Conditions Index also witnessed a decline, dropping from 81.9 in January to 79.4 in February 2024, which translates to a 3.1% decrease. However, this dip does not overshadow the 12.3% year-over-year improvement from February 2023's 70.7, indicating that consumers perceive a stronger economy now than they did a year ago.

On the other hand, the Index of Consumer Expectations, which measures future economic prospects, decreased by 2.5% to 75.2 from January's 77.1. Yet, it stands 16.6% higher than the previous year's 64.5, suggesting a growing optimism about the economic future despite the slight month-to-month contraction.

Inflation Expectations: A Silver Lining?

A critical aspect of the report is the nuanced understanding of inflation expectations. Year-ahead inflation expectations edged up slightly from 2.9% in January to 3.0% in February. This subtle increase is within the 2.3-3.0% range observed in 2018 and 2019, indicating that short-run inflation expectations are stabilizing within pre-pandemic norms. Long-run inflation expectations remained steady at 2.9% for the third consecutive month, consistently within the narrow 2.9-3.1% range for 28 of the last 31 months. This steadiness, slightly above the 2.2-2.6% range seen in the two years pre-pandemic, suggests a cautious but stable outlook on inflation among consumers.

Partisan Perceptions and Economic Outlook

The featured chart on "Partisan Perceptions and Expectations" from February 23, 2024, further enriches the narrative by illustrating how political affiliations may influence economic perceptions and expectations. This aspect underscores the complexity of consumer sentiment and its susceptibility to broader socio-political dynamics.

Forward Look

Consumer sentiment's slight dip in February 2024, juxtaposed against the backdrop of significant year-over-year gains, offers a multi-dimensional view of the consumer psyche. The steadiness in long-term inflation expectations and the modest increase in short-term views reflect a cautious optimism among consumers. They seem assured by the trajectory of the economy and inflation, despite recognizing the uncertainties that lie ahead.

As we await the next data release on March 15, 2024, for preliminary March data, it will be intriguing to see how these trends evolve. Will consumer sentiment continue to hold the gains of the past months, or will new economic developments sway the public's confidence? Only time will tell, but for now, the February report provides a substantive basis for understanding current consumer attitudes towards the economy and inflation.

Source: http://www.sca.isr.umich.edu

Start futures and forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feeds for US macro-economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.