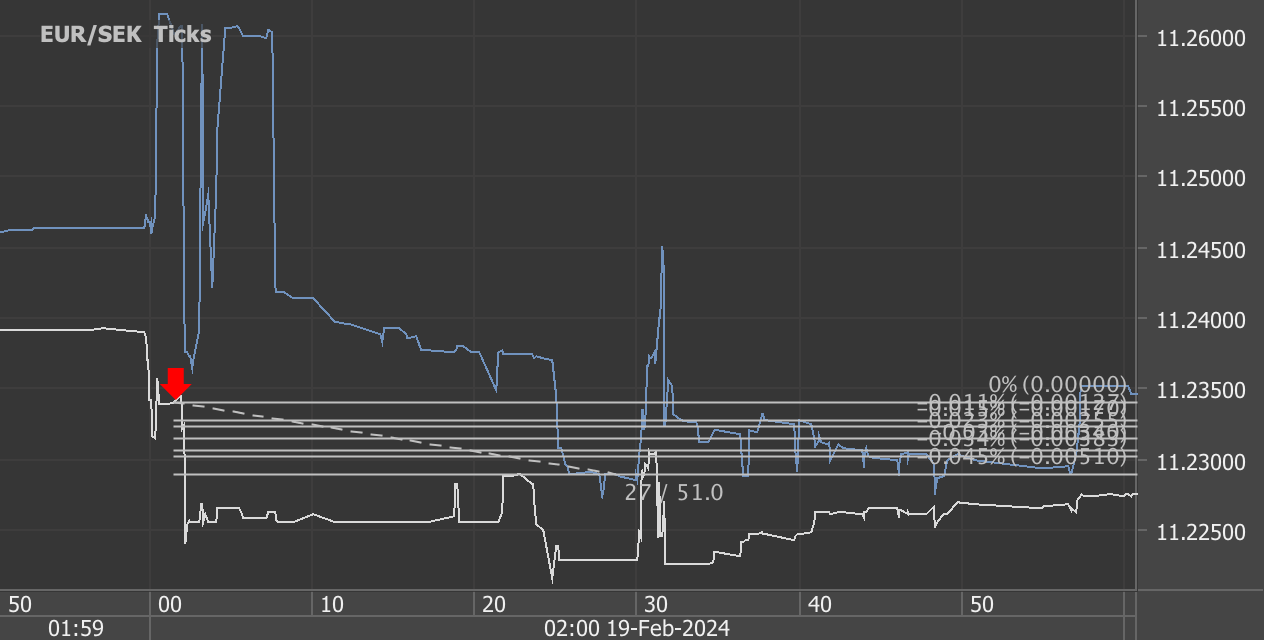

According to our analysis EURSEK moved 51 pips on Sweden Consumer Price Index (CPI) data on 19 February 2024.

EURSEK (51 pips)

Charts are exported from JForex (Dukascopy).

Understanding Sweden's January 2024 Inflation Dynamics

In the crisp winter month of January 2024, Sweden experienced a notable uptick in its inflation rate, which climbed to 5.4 percent, according to the Consumer Price Index (CPI). This marked a significant increase from the 4.4 percent inflation rate observed in December. This shift has drawn considerable attention from economists, policymakers, and the public alike, as it signals changes in the economic landscape that could have widespread implications.

The Details Behind the Numbers

The latest statistical news from Statistics Sweden, released on February 19, 2024, paints a comprehensive picture of the current inflationary trends. On a month-to-month basis, the CPI saw a slight decrease of 0.1 percent from December to January. However, when looking at the bigger picture, the annual inflation rate according to the CPIF (Consumer Price Index with a fixed interest rate) settled at 3.3 percent in January, revealing the nuanced dynamics at play in the Swedish economy.

Housing Costs: The Major Inflation Driver

A key factor contributing to the rise in the inflation rate is the increase in housing costs. Mikael Nordin, a statistician at Statistics Sweden, emphasized that housing continues to be the largest contributor to the CPI-driven inflation rate. This is a trend observed not just in Sweden but globally, as housing markets adjust to post-pandemic realities and changing interest rate environments.

Diving Deeper into the CPI Components

The CPI, which serves as a measure of the average price basket of goods and services purchased by households, increased to 412.74, with housing, electricity, and mortgage costs leading the charge. Notably, the interest rates for household mortgages played a significant role, contributing 2.3 percentage points to the annual inflation rate.

On the flip side, seasonal price decreases in clothing and air travel, along with a significant 11 percent drop in fuel prices, primarily due to lower diesel prices, helped to temper the overall inflation rate. This demonstrates the complex interplay of various factors that drive inflation, from global oil prices to local consumption patterns.

The CPIF and CPIF-XE Indices

The CPIF and CPIF-XE indices offer additional insights into the inflationary landscape. The CPIF-XE, which excludes volatile energy prices, posted a 4.4 percent inflation rate, down from 5.3 percent in December. This indicates that, excluding energy, the core inflationary pressures remain significant, though slightly alleviated compared to the end of the previous year.

The Broader Economic Implications

The inflation data for January 2024 provides a crucial snapshot of Sweden's economic health and the challenges it faces. Rising inflation can erode purchasing power and impact living standards, prompting the central bank to potentially adjust monetary policy to keep inflation in check. For households, the increase in mortgage costs and housing expenses highlights the need for careful financial planning and budgeting.

Looking Ahead

As we move further into 2024, it will be vital to monitor how Sweden's inflation trajectory evolves, especially in response to policy measures and global economic trends. The next publication from Statistics Sweden, due on March 14, 2024, will be eagerly awaited for further clues on the direction of the Swedish economy.

In the meantime, individuals and businesses alike must navigate the inflationary landscape with a keen eye on budgeting and financial planning, as the effects of inflation permeate through various sectors of the economy.

Start futures forex fx news trading with Haawks G4A low latency machine-readable data today, one of the fastest news data feeds for US economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.