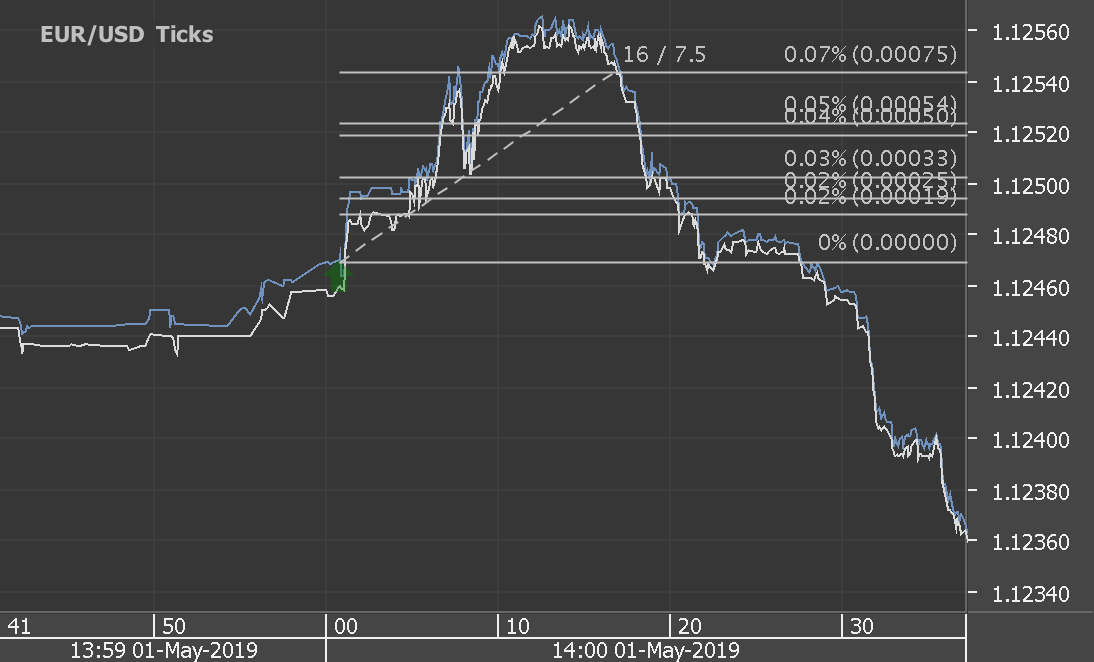

According to our analysis EURUSD, USDJPY and GBPUSD moved 17 pips on FOMC statement data on 1 May 2019. There was no change in the federal funds rate. As also announced in January and March less likely adjustments (raising) of the federal funds rate in the near future was another time the initial trigger for the US dollar losses against major currencies. Please find the exact phrases from the January, March and May statements below.

“In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.”

“In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.”

“In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.”

Start forex fx news trading with Haawks G4A low latency machine-readable data today, the fastest news data feed for FOMC data which includes federal funds rate, statement and projections.

EURUSD (7 pips)

USDJPY (5 pips)

GBPUSD (5 pips)

Charts are exported from JForex (Dukascopy).