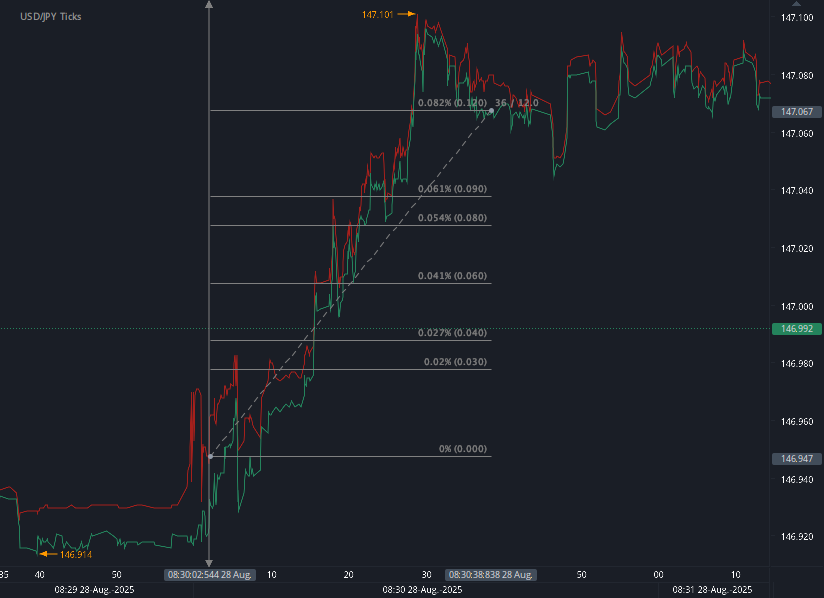

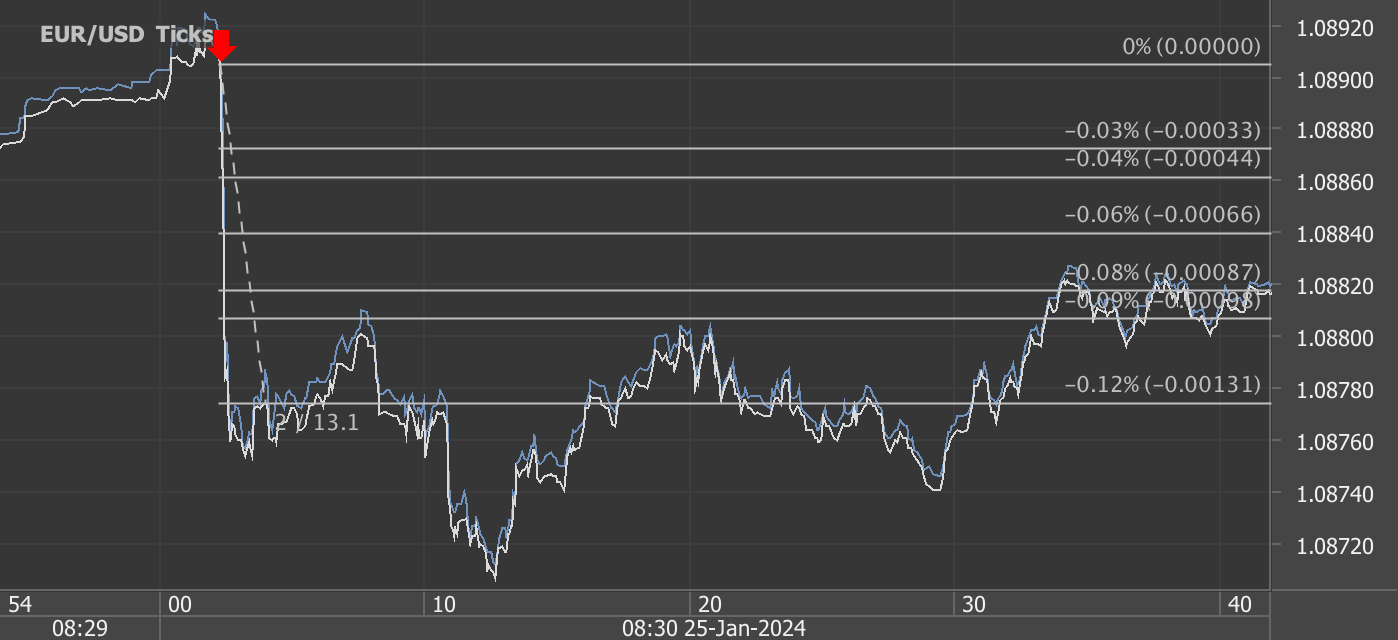

According to our analysis USDJPY and EURUSD moved 15 pips on US Gross Domestic Product (GDP) data on 28 August 2025.

USDJPY (12 pips)

EURUSD (3 pips)

Charts are exported from JForex (Dukascopy).

U.S. Economy Rebounds in Q2 2025: GDP Grows 3.3%

The U.S. economy showed strong momentum in the second quarter of 2025, according to the Bureau of Economic Analysis (BEA). After contracting slightly in the first quarter, real gross domestic product (GDP) grew at an annual rate of 3.3% from April through June. This second estimate is stronger than the initial reading of 3.0%, reflecting upward revisions in investment and consumer spending.

What’s Driving Growth?

The rebound in GDP was fueled by:

Fewer imports – A decline in imports, which are subtracted in GDP calculations, gave the headline number a lift.

Stronger consumer spending – Household demand accelerated, particularly in health care, pharmaceuticals, food services, and accommodations.

Investment gains – Upward revisions in intellectual property (software and R&D), equipment (led by light trucks), and structures (notably commercial and health care) all contributed.

These positive shifts were partly offset by weaker government spending and higher imports of certain goods, such as industrial supplies and capital goods.

Key Economic Indicators from Q2 2025

Real GDP: +3.3% (up from -0.5% in Q1)

Current-dollar GDP: +5.3%

Real Final Sales to Private Domestic Purchasers: +1.9% (a sharp upward revision from +1.2%)

Real Gross Domestic Income (GDI): +4.8% (vs. +0.2% in Q1)

Average of GDP and GDI: +4.0%

Price Index for Gross Domestic Purchases: +1.8%

PCE Price Index: +2.0% (2.5% excluding food and energy)

Corporate Profits Bounce Back

After falling $90.6 billion in the first quarter, corporate profits rose by $65.5 billion in Q2. The turnaround signals improving business conditions alongside consumer strength.

Inflation Check

Inflation pressures remained moderate:

The gross domestic purchases price index rose 1.8%.

The PCE price index, the Federal Reserve’s preferred gauge, climbed 2.0%.

Core PCE (excluding food and energy) rose 2.5%, unchanged from the initial estimate.

Why the Upward Revision?

The BEA revised Q2 growth higher mainly because of:

Better-than-expected consumer spending on goods and services.

New data showing stronger business investment in software, R&D, light trucks, and construction.

Adjustments in trade data, especially petroleum exports and industrial supplies imports.

What’s Next?

The BEA will release its third estimate of Q2 GDP along with updated data on GDP by industry and revised corporate profits on September 25, 2025. This release will also incorporate results from the annual update of the National Economic Accounts, which could shift historical growth patterns.

Bottom Line

After a sluggish start to 2025, the U.S. economy appears to be on a firmer footing. Robust consumer demand, healthier corporate profits, and easing inflation pressures suggest that growth could continue into the second half of the year—though much will depend on investment trends, trade dynamics, and the Federal Reserve’s policy stance.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Always conduct thorough research and consider seeking advice from a financial professional before making any investment decisions.

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feeds for macro-economic and commodity data from the US and Europe.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.