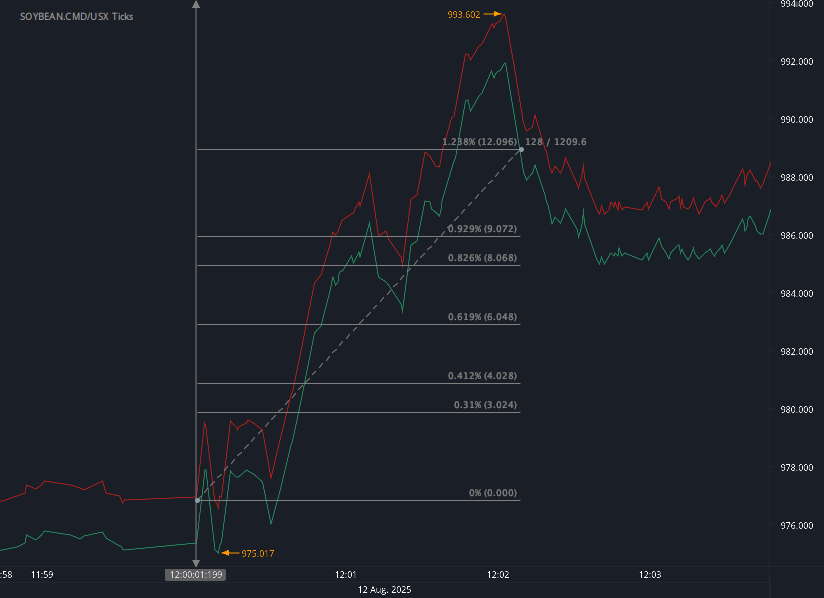

According to our analysis corn (ZC), wheat (WC) and soybeans (ZS) futures prices moved around 96 ticks (28 ticks, 20 ticks, 48 ticks) on USDA WASDE (World Agricultural Supply and Demand Estimates) data on 12 August 2025.

Soybeans (48 ticks)

Charts are exported from JForex (Dukascopy).

August 2025 WASDE Report: Record Crops, Price Shifts, and Global Supply Changes

The USDA’s latest World Agricultural Supply and Demand Estimates (WASDE), released August 12, 2025, paints a complex picture for the coming marketing year. While some U.S. crops are setting production records, others are tightening in supply, with global market ripples reaching nearly every major commodity. Here’s a breakdown of the key takeaways.

Wheat: Slightly Tighter in the U.S., Lower Stocks Worldwide

U.S. Outlook:

Supplies: Down slightly to 1.927 billion bushels due to reduced harvested area, even as yields tick up to 52.7 bu/acre.

Use: Domestic use trimmed by 5 million bushels (mainly food), but exports up 25 million thanks to strong sales of Hard Red Winter wheat.

Ending Stocks: Cut to 869 million bushels.

Price: Lowered 10 cents to $5.30/bu.

Global Outlook:

Supplies: Down 2.5 million tons due to lower production in China, Brazil, and Argentina.

Consumption: Down 1.1 million tons, with feed use weaker in several Asian countries.

Trade: Slightly higher, led by U.S. exports.

Ending Stocks: Dropped to 260.1 million tons, the lowest since 2015/16.

Corn & Coarse Grains: Record U.S. Crop, Prices Under Pressure

U.S. Corn:

Production: A record 16.7 billion bushels, up 1 billion from last month on bigger acreage and a yield forecast of 188.8 bu/acre.

Use: Domestic use up 545 million bushels, with feed demand surging.

Exports: Projected record 2.9 billion bushels.

Ending Stocks: Up to 2.1 billion bushels, highest since 2018/19.

Price: Lowered 30 cents to $3.90/bu.

Global Coarse Grains:

Production: Higher overall, but foreign output down in the EU and Serbia from heat/dryness.

Stocks: Global corn ending stocks up to 282.6 million tons.

Rice: Bigger U.S. Harvest, Global Stocks Ease

U.S. Outlook:

Production: 208.5 million cwt, higher on acreage despite a yield drop.

Exports: Up to 97 million cwt, with strong medium/short-grain sales to Japan.

Ending Stocks: 44.6 million cwt, down 12% year-over-year.

Price: Higher for California medium/short-grain, overall $14.20/cwt.

Global Outlook:

Supplies: Slight dip to 728.7 million tons.

Consumption: Record 542 million tons.

Ending Stocks: Down to 186.7 million tons.

Oilseeds: U.S. Soybeans Tighter on Lower Area

U.S. Soybeans:

Production: 4.3 billion bushels, down 43 million on smaller acreage despite higher yields (53.6 bu/acre).

Exports: Cut 40 million bushels on slow early sales.

Ending Stocks: Down to 290 million bushels.

Price: Unchanged at $10.10/bu.

Global Soybeans:

Production: Lower in the U.S. and Serbia.

Stocks: Down 1.2 million tons to 124.9 million.

Sugar: More U.S. Supply, Higher Stocks

2025/26 U.S. Sugar:

Production: Higher for both beet and cane sugar, especially in Louisiana.

Ending Stocks: Up to 2.16 million STRV, boosting the stocks-to-use ratio to 17.75%.

Livestock, Poultry & Dairy: Shifts in Meat Mix, Firm Milk Output

Meat Production:

Beef & Pork: Lower on reduced slaughter and lighter weights.

Poultry: Broilers up; turkey down. Eggs slightly lower.

Prices:

Cattle & Hogs: Higher into 2026.

Broilers: Lower in the second half of 2025.

Turkey: Higher on tight red meat supplies.

Milk: Output forecasts raised; 2025 all-milk price steady at $22.00/cwt.

Cotton: Smaller U.S. Crop Tightens Supplies

Production: Cut to 13.2 million bales, down 1.4 million from July on higher abandonment in the Southwest.

Exports: Down 500,000 bales.

Ending Stocks: Down to 3.6 million bales.

Price: Up to 64¢/lb.

Global: Production, consumption, and trade all down; ending stocks reduced over 3.4 million bales.

The Big Picture

August’s WASDE tells two main stories: record corn production pushing prices down and tightness in wheat, soybeans, cotton, and some livestock products supporting prices. Global weather, shifting trade patterns, and domestic supply surges are setting up a marketing year of both opportunity and volatility.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Always conduct thorough research and consider seeking advice from a financial professional before making any investment decisions.

Source: https://www.usda.gov/oce/commodity/wasde/wasde0825.pdf

Haawks G4A is one of the fastest machine-readable data feeds for USDA data. We are beating big names in the industry by seconds. Coverage includes monthly USDA WASDE (World Agricultural Supply and Demand Estimates), quarterly USDA Grain Stocks and yearly USDA Prospective Plantings and USDA Acreage.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.