According to our analysis USDJPY and EURUSD moved 48 pips on US Gross Domestic Product (GDP) data on 25 January 2024.

USDJPY (35 pips)

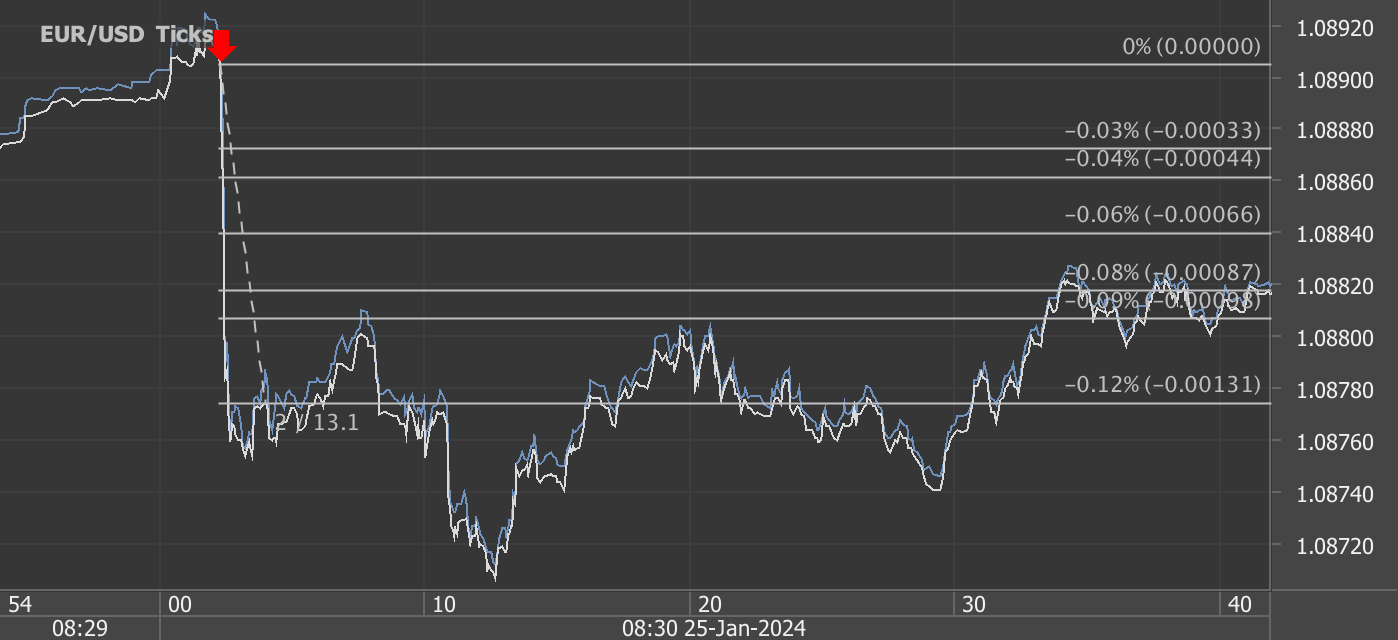

EURUSD (13 pips)

Charts are exported from JForex (Dukascopy).

The advance estimate of the U.S. Gross Domestic Product (GDP) for the fourth quarter of 2023 shows a 3.3% annual growth rate, a slight deceleration from the 4.9% increase in the third quarter. Key growth drivers included consumer spending, exports, government spending, and investments in nonresidential and residential sectors. Consumer spending rose notably in services and goods, with significant contributions from health care and recreational goods. Increases in federal spending were more evident in nondefense areas, while state and local government spending also rose.

Both imports and exports increased, with exports led by petroleum and financial services. However, the fourth quarter saw a slowdown in private inventory investment, federal government spending, residential fixed investment, and consumer spending.

For the entire year of 2023, the real GDP grew by 2.5%, supported by consumer spending, nonresidential fixed investment, government spending, and exports, reaching a current-dollar GDP of $27.36 trillion, a 6.3% increase. Inflation indicators, such as the price index for gross domestic purchases and the personal consumption expenditures (PCE) price index, increased but at a slower rate compared to 2022. Personal income and disposable personal income also saw increases, though the personal saving rate dropped slightly to 4.0% in the fourth quarter.

The report, based on preliminary data, is subject to revision, with a more comprehensive update scheduled for February 28, 2024.

Source: https://www.bea.gov/news/2024/gross-domestic-product-fourth-quarter-and-year-2023-advance-estimate

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feeds for US economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.