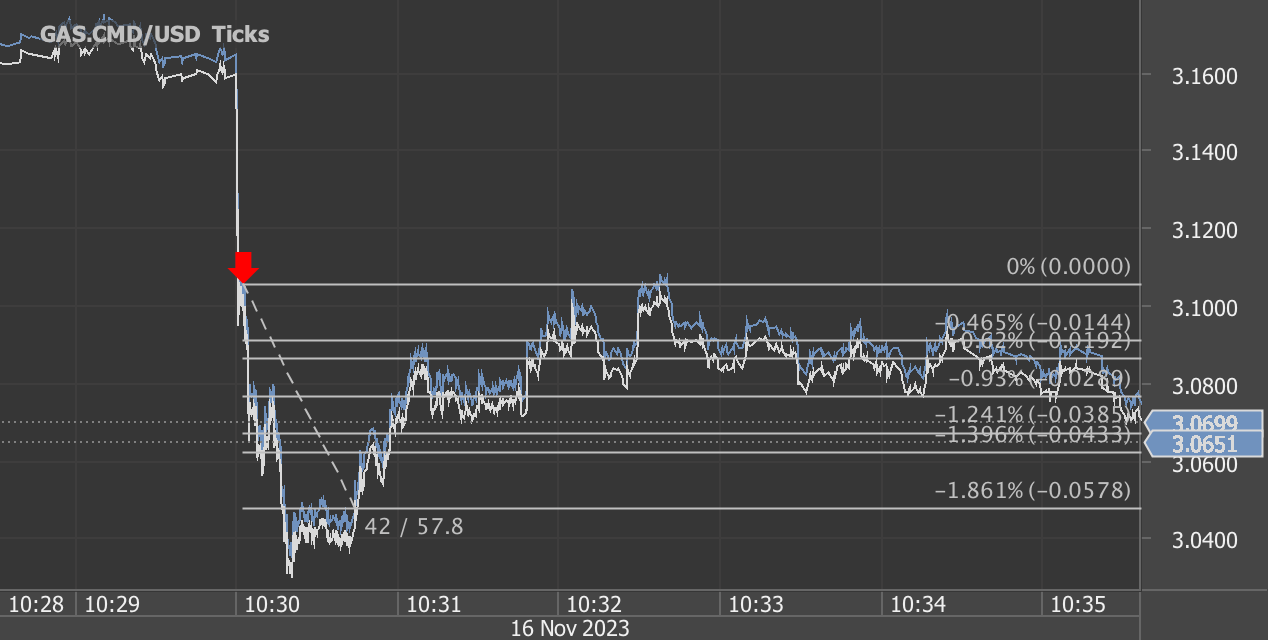

According to our analysis USDJPY and EURUSD moved 47 pips on University Michigan Consumer Sentiment / Inflation Expectations data on 8 December 2023.

USDJPY (30 pips)

EURUSD (17 pips)

Charts are exported from JForex (Dukascopy).

In December 2023, consumer sentiment in the United States experienced a substantial rebound, with a 13.2% increase from the previous month and a notable 16.1% improvement compared to December 2022. This surge, as reflected in the Index of Consumer Sentiment, marks a recovery from declines observed over the past four months. The Current Economic Conditions index also rose by 8.3% month-to-month and exhibited a remarkable 24.2% improvement compared to the same period last year. Similarly, the Index of Consumer Expectations increased by 16.9% compared to November 2023 and showed a 10.7% improvement year-over-year.

The positive shift in sentiment is attributed to improvements in the expected trajectory of inflation. Year-ahead inflation expectations dropped from 4.5% to 3.1%, reaching the lowest level since March 2021. Long-run inflation expectations also decreased from 3.2% to 2.8%, matching the second-lowest reading since July 2021. Despite these declines, long-run inflation expectations remain elevated relative to pre-pandemic levels.

All five components of the consumer sentiment index rose, with significant surges observed in the short and long-run outlook for business conditions. The improved sentiment was widespread, cutting across various demographics, including age, income, education, geography, and political identification.

Approximately 14% of consumers spontaneously mentioned the potential impact of next year's elections, and their sentiment appeared to incorporate expectations favorable to the economy. The next data release is scheduled for Friday, December 22, 2023, for the final December data, providing further insights into the evolving economic landscape.

Source: http://www.sca.isr.umich.edu

Start futures and forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feeds for US macro-economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.