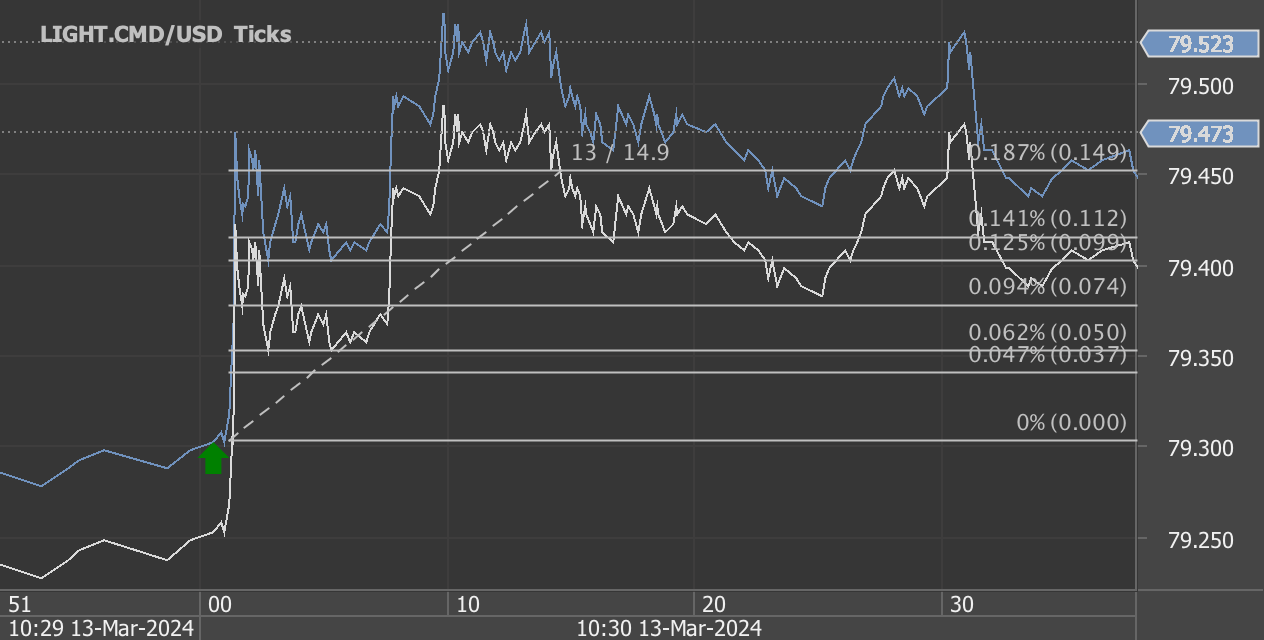

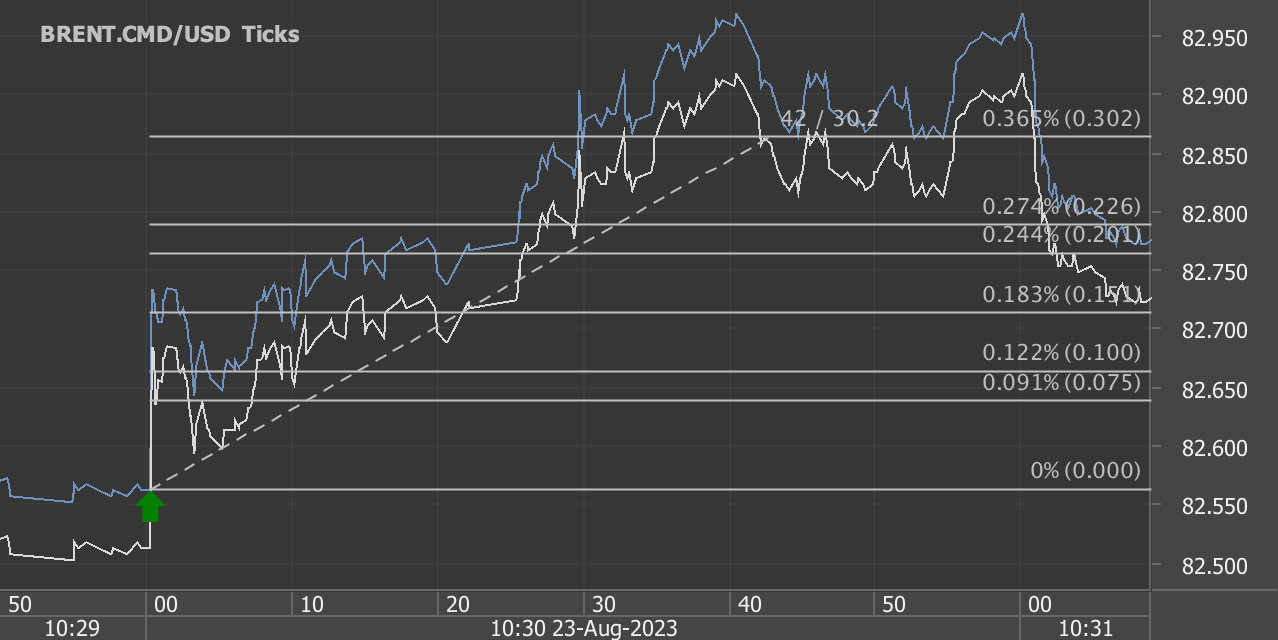

According to our analysis crude oil moved 42 ticks on DOE Petroleum Status Report data on 21 May 2025.

Light sweet crude oil (42 ticks)

Charts are exported from JForex (Dukascopy).

U.S. Weekly Petroleum Update: Refinery Activity Rises, Inventories Continue to Build

Published: May 21, 2025

The U.S. Energy Information Administration’s (EIA) latest weekly petroleum data, covering the week ending May 16, 2025, reveals a modest uptick in refinery operations and a continued rise in inventories across several fuel categories, even as product demand shows year-over-year declines.

Refinery Inputs and Production

U.S. crude oil refinery inputs averaged 16.5 million barrels per day, an increase of 89,000 barrels per day compared to the previous week. Refineries operated at 90.7% capacity, maintaining a strong operational pace heading into the summer driving season.

Fuel production also saw gains:

Gasoline production rose to an average of 9.6 million barrels per day.

Distillate fuel production increased significantly, up 131,000 barrels per day to an average of 4.7 million barrels per day.

Imports on the Rise

Crude oil imports increased notably, averaging 6.1 million barrels per day, up 247,000 barrels per day from the week prior. Despite the weekly increase, the four-week average of 5.9 million barrels per day still lags 13.5% behind the same period last year.

Other key import figures:

Motor gasoline imports averaged 747,000 barrels per day.

Distillate fuel imports averaged 141,000 barrels per day.

Inventory Levels Continue to Climb

Commercial petroleum inventories grew across the board last week:

Crude oil inventories (excluding the Strategic Petroleum Reserve) rose by 1.3 million barrels, totaling 443.2 million barrels. This places current stockpiles about 6% below the five-year seasonal average.

Motor gasoline inventories increased by 0.8 million barrels, now standing about 2% below the five-year average.

Distillate fuel inventories rose by 0.6 million barrels, though they remain 16% below the seasonal norm.

Propane/propylene inventories surged by 2.7 million barrels, but still sit 7% below average levels.

In total, commercial petroleum inventories rose by 4.9 million barrels.

Product Demand Trends

Despite the increases in production and inventory, product demand remains soft:

Total products supplied averaged 19.6 million barrels per day over the past four weeks, a 2.8% decrease from the same period last year.

Motor gasoline demand dipped by 1%, averaging 8.8 million barrels per day.

Distillate fuel demand saw a sharper drop of 4.2%, averaging 3.6 million barrels per day.

On a brighter note, jet fuel demand climbed 4% year-over-year.

Takeaway

The latest data points to a petroleum market that is stabilizing in supply but facing persistent demand headwinds. With refinery utilization high and inventories rising, the market may be well-positioned for summer travel season, but muted year-over-year product demand could temper price pressures in the near term.

Stay tuned for more updates and analysis as the season progresses.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Always conduct thorough research and consider seeking advice from a financial professional before making any investment decisions.

Start futures forex fx commodity news trading with Haawks G4A low latency machine-readable data, one of the fastest data feeds for DOE data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.