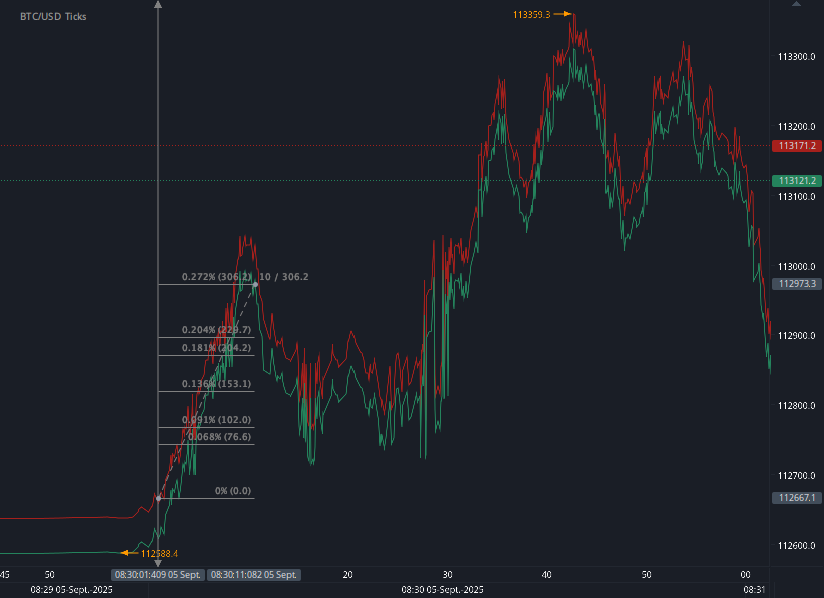

According to our analysis USDJPY and EURUSD moved 68 pips and BTC moved 306 points on US Employment Situation (Non-farm payrolls / NFP) data on 5 September 2025.

USDJPY (42 pips)

EURUSD (26 pips)

BTC (306 points)

Charts are exported from JForex (Dukascopy).

U.S. Jobs Report: August 2025 Employment Situation

The U.S. labor market showed little momentum in August 2025, according to the latest report from the Bureau of Labor Statistics (BLS). Nonfarm payroll employment edged up by just 22,000 jobs, while the unemployment rate held steady at 4.3%. Since April, overall job growth has been subdued, with gains in health care tempered by losses in government and energy-related industries.

Key Highlights from the Household Survey

Unemployment rate: 4.3%, essentially unchanged for the month.

Number of unemployed people: 7.4 million.

Long-term unemployment: 1.9 million, accounting for 25.7% of all unemployed, and up 385,000 over the past year.

Labor force participation: 62.3%, down 0.4 percentage point over the year.

Employment-population ratio: 59.6%, unchanged from July but also down over the year.

Part-time for economic reasons: 4.7 million, little changed in August.

Not in the labor force but want a job: 6.4 million, up 722,000 compared to last year.

Unemployment rates across major demographic groups—adult men (4.1%), adult women (3.8%), teenagers (13.9%), Whites (3.7%), Blacks (7.5%), Asians (3.6%), and Hispanics (5.3%)—showed little or no movement.

Key Highlights from the Establishment Survey

Total payroll employment: +22,000 jobs in August.

Health care: +31,000 jobs, led by gains in ambulatory services, hospitals, and nursing/residential care.

Social assistance: +16,000 jobs, mainly in individual and family services.

Federal government: -15,000 jobs, continuing a steady decline since January (down 97,000 total).

Mining, quarrying, and oil & gas extraction: -6,000 jobs, the sharpest monthly drop in over a year.

Wholesale trade: -12,000 jobs, down 32,000 since May.

Manufacturing: -12,000 jobs, with a notable -15,000 decline in transportation equipment manufacturing, partly due to strike activity.

Other major sectors—including construction, retail trade, financial activities, leisure and hospitality—showed little change in August.

Wages and Work Hours

Average hourly earnings: $36.53, up 10 cents (0.3%) in August. Over the past year, wages increased by 3.7%.

Production and nonsupervisory employees: $31.46 per hour, up 12 cents (0.4%).

Average workweek: 34.2 hours for all employees, unchanged for the third straight month.

Manufacturing workweek: slipped slightly to 40.0 hours, with overtime steady at 2.9 hours.

Revisions to Prior Months

June 2025 revised down to -13,000 (from +14,000).

July 2025 revised up to +79,000 (from +73,000).

Combined revisions: net 21,000 fewer jobs than previously reported.

What’s Next?

The September Employment Situation Report will be released on Friday, October 3, 2025. In addition, the BLS will issue its 2025 preliminary benchmark revision to payroll data on September 9, 2025, aligning survey estimates with unemployment insurance records.

Takeaway

The August report underscores a cooling labor market: job gains remain concentrated in health and social services, while government, manufacturing, and energy sectors shed jobs. Wage growth continues at a moderate pace, but labor force participation remains historically low. With revisions showing weaker summer job growth than initially reported, policymakers and businesses alike may be watching closely for signs of whether this slowdown persists into the fall.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Always conduct thorough research and consider seeking advice from a financial professional before making any investment decisions.

Start forex fx futures news trading with Haawks G4A low latency machine-readable data today, one of the fastest news data feeds for US macro-economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.