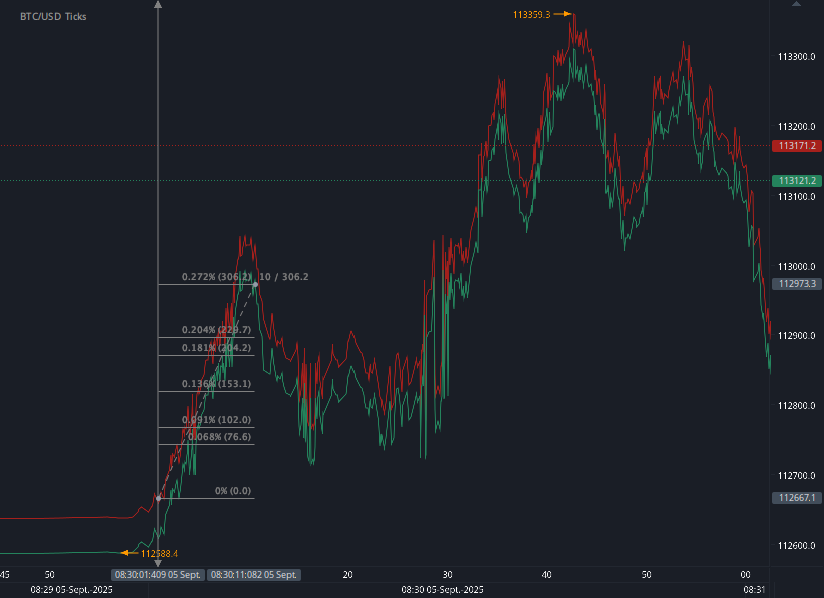

According to our analysis USDJPY and EURUSD moved 60 pips on US Employment Situation (Non-farm payrolls / NFP) data on 11 February 2026.

USDJPY (36 pips)

EURUSD (24 pips)

Charts are exported from JForex (Dukascopy).

U.S. Jobs Report – January 2026

Payrolls Rise by 130,000; Unemployment Rate Steady at 4.3%

The latest Employment Situation report from the U.S. Bureau of Labor Statistics shows a modest start to 2026. In January, total nonfarm payroll employment increased by 130,000 jobs, while the unemployment rate held steady at 4.3%.

Here’s what the numbers reveal about the current state of the labor market.

The Big Picture

130,000 jobs added in January

Unemployment rate: 4.3% (unchanged)

Average hourly earnings: Up 0.4% to $37.17

Year-over-year wage growth: 3.7%

Labor force participation rate: 62.5% (little change)

While job growth continues, it remains moderate compared with historical expansion periods. The unemployment rate is slightly higher than a year ago (4.0% in January 2025), suggesting some cooling compared to last year.

Where Jobs Are Growing

Health Care Leads

Health care added 82,000 jobs in January:

+50,000 in ambulatory health care services

+18,000 in hospitals

+13,000 in nursing and residential care facilities

Health care averaged 33,000 jobs per month in 2025, making January’s increase notably strong.

Social Assistance Expands

Employment in social assistance rose by 42,000 jobs, primarily in individual and family services, reflecting continued demand for community-based support services.

Construction Rebounds

Construction added 33,000 jobs, largely in nonresidential specialty trade contractors (+25,000). After being essentially flat in 2025, the sector showed renewed momentum in January.

Sectors Losing Jobs

Not all industries expanded:

Federal government employment declined by 34,000, continuing a downward trend that began after a peak in October 2024. Since then, federal payrolls are down 327,000 jobs (−10.9%).

Financial activities fell by 22,000 jobs, including losses in insurance carriers.

These declines partially offset gains in health care and construction.

Household Survey Highlights

The household survey shows a largely stable labor market:

7.4 million unemployed Americans

Long-term unemployed (27+ weeks): 1.8 million

Long-term unemployed account for 25% of all unemployed

Teen unemployment declined to 13.6%, while unemployment rates for adult men (3.8%), adult women (4.0%), and major racial and ethnic groups were largely unchanged.

The number of people working part time for economic reasons fell by 453,000 in January, though it remains higher than a year ago.

Wages and Hours

Wage growth remains steady:

Average hourly earnings: $37.17

Up 15 cents (0.4%) in January

Up 3.7% over the past year

For production and nonsupervisory workers:

$31.95 per hour

Also up 0.4% over the month

The average workweek edged up to 34.3 hours, suggesting stable labor demand.

Revisions and Benchmarking

The January release includes annual benchmark revisions:

March 2025 total nonfarm employment was revised down by 898,000 (seasonally adjusted).

2025 job growth was revised from +584,000 to +181,000.

These revisions reflect updated payroll data from unemployment insurance records and improved seasonal adjustments — a standard statistical process designed to enhance accuracy.

Weather Impact?

Major winter storms affected large parts of the country in January. According to the BLS, they had no discernible impact on national payroll employment or unemployment rates, though survey response rates were slightly below average.

What This Means

January’s report shows:

Continued but moderate job growth

Stable unemployment

Solid wage gains

Sector-specific strength in health care and services

Ongoing weakness in federal government and financial activities

Overall, the labor market remains resilient but is expanding at a measured pace. The next Employment Situation report, due in early March, will provide further insight into whether this steady trend continues.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Always conduct thorough research and consider seeking advice from a financial professional before making any investment decisions.

Start forex fx futures news trading with Haawks G4A low latency machine-readable data today, one of the fastest news data feeds for US macro-economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.